What is a Processing Fee for Credit Cards?

What is a Processing Fee?

When you make a purchase with a credit card, the merchant incurs a cost in order to process your transaction. Let’s break down what a processing fee is and its significance for both consumers and businesses.

This charge, known as a processing fee, usually consists of the costs associated with transmitting the transaction through the appropriate networks, verifying your identity as a legitimate cardholder, and handling other aspects of facilitating the transaction, such as fraud prevention and payment settlement.

Processing fees vary depending on a variety of factors, including the card type (e.g., debit card, credit card, rewards card), the payment network used (e.g., Visa, Mastercard, American Express), and the specific arrangement between the merchant and their payment processor. Some processors may implement tiered pricing based on factors like the merchant’s industry or transaction volume.

Components of Processing Fees: A Comprehensive Breakdown

To understand the dynamics of processing fees, it’s important to delve into their key components. Processing fees for credit cards typically comprise the following:

– Interchange Fees: These are fees charged by the issuing bank, the financial institution that provides the customer with the credit card, to the acquiring bank, the financial institution that handles the transaction for the merchant. Interchange fees serve as a form of compensation for the issuing bank for providing the customer with the credit facility and managing the risk associated with the transaction.

Interchange fees vary across card types and are often higher for credit cards than for debit cards. Card networks like Visa and Mastercard set general guidelines for interchange fees, but individual issuing banks have some flexibility in setting their own rates within these guidelines.

– Network Fees: Network fees are charged by the payment networks themselves (e.g., Visa, Mastercard) to facilitate the processing of transactions. These fees cover the costs incurred by the networks for maintaining and operating their payment systems, which include network infrastructure, data security, and fraud monitoring.

Network fees are usually a fixed amount per transaction and can vary based on the specific network used. For instance, the fees charged by Visa may differ from those charged by Mastercard.

– Acquirer Fees: Acquirer fees are charged by the acquiring bank to the merchant for handling the transaction. These fees cover the costs incurred by the acquiring bank for providing services such as authorization, settlement, and customer support to the merchant.

Acquirer fees can vary depending on the merchant’s business model, industry, and transaction volume. Some acquiring banks may offer tiered pricing based on the number of transactions processed or the volume of sales.

– Other Fees: In addition to the aforementioned components, merchants may incur additional fees for certain services or features provided by their payment processors. These services could include fraud protection, chargeback management, and reporting tools.

The specific fees and their rates can vary depending on the payment processor and the services offered. It’s important for merchants to understand the complete fee structure before selecting a payment processor.

The Impact of Processing Fees on Businesses and Consumers: A Double-Edged Sword

Processing fees have a significant impact on both businesses and consumers. For businesses, processing fees represent a cost of doing business. Merchants factor these fees into their pricing and operating expenses, which can ultimately affect the prices of goods and services for consumers.

While processing fees provide revenue to card issuers, payment networks, and acquiring banks, there is an ongoing debate about the reasonableness of these fees. Some argue that processing fees are too high and can stifle innovation and competition in the payments industry.

Consumers, on the other hand, may not directly see the processing fees associated with their credit card transactions. However, these fees can indirectly impact consumers through higher prices or reduced rewards and benefits offered by credit card issuers.

Transparency and Regulation: Addressing Concerns and Striking a Balance

In response to concerns about processing fees, there have been efforts to increase transparency and regulation in the payments industry. In the United States, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 included provisions to enhance transparency and fairness in the credit card market, including measures to limit excessive interchange fees.

The Federal Reserve Board and other regulatory bodies have also taken steps to promote competition and innovation in the payments industry. These efforts aim to strike a balance between protecting consumers and ensuring a fair and efficient payments system that benefits all stakeholders.

Conclusion: Navigating the Landscape of Processing Fees

Processing fees are an integral part of the credit card ecosystem, affecting both businesses and consumers. Understanding the components and dynamics of processing fees is essential for merchants to optimize their payment strategies.

Transparency and regulation play crucial roles in addressing concerns about the reasonableness of processing fees. As the payments industry continues to evolve, it remains to be seen how these fees will adapt to the changing landscape.

Ultimately, the goal is to create a fair and transparent system that balances the interests of all parties involved – businesses, consumers, and the providers of payment services.

What Is a Processing Fee for Credit Cards?

When you swipe your plastic at the grocery store or pay for a round of drinks with a credit card, you might not realize that there’s a hidden cost lurking behind the scenes. That cost is called a processing fee, and it’s a fee that merchants pay to credit card companies every time a customer uses a credit card to make a purchase.

Processing fees are typically a percentage of the total purchase amount, and they can range from 1% to 3%. So, if you buy a $100 item with a credit card, the merchant will likely have to pay a processing fee of $1 to $3.

Who Pays the Processing Fee?

Merchants typically pay the processing fee, which is passed on to the customer in the form of higher prices. In other words, every time you use a credit card, you’re actually paying a little bit more for the convenience of not having to carry cash.

How Much Do Merchants Pay in Processing Fees?

The amount that merchants pay in processing fees can vary depending on a number of factors, including the type of business, the size of the business, and the type of credit card that is being used. However, according to a study by the Nilson Report, merchants in the United States paid an average of 2.67% in processing fees in 2021.

Are Processing Fees Legal?

Yes, processing fees are legal. In fact, they are regulated by the Federal Reserve. The Fed has set a limit on the amount that merchants can charge in processing fees, and this limit is currently 0.15% for credit cards and 0.50% for debit cards.

Why Do Merchants Charge Processing Fees?

Merchants charge processing fees to cover the cost of accepting credit cards. These costs include the cost of processing the transaction, the cost of fraud protection, and the cost of customer service.

The Cost of Processing the Transaction

The cost of processing a credit card transaction includes the cost of the equipment needed to process the transaction, the cost of the software needed to process the transaction, and the cost of the labor needed to process the transaction.

The Cost of Fraud Protection

Credit card fraud is a major problem for merchants. In fact, merchants lose billions of dollars each year to credit card fraud. To protect themselves from fraud, merchants must invest in fraud protection measures, such as fraud detection software and fraud prevention training for employees.

The Cost of Customer Service

Merchants must also provide customer service to their customers. This includes answering questions about credit card transactions, resolving disputes, and handling chargebacks. The cost of customer service can be significant, especially for merchants who have a large number of customers.

Are Processing Fees Worth It for Merchants?

Whether or not processing fees are worth it for merchants depends on a number of factors, including the type of business, the size of the business, and the type of credit card that is being used. However, in general, processing fees are a necessary cost of doing business for merchants who accept credit cards.

The Benefits of Accepting Credit Cards

There are a number of benefits to accepting credit cards, including:

- Increased sales: Customers are more likely to make purchases when they can use a credit card.

- Improved customer convenience: Customers appreciate the convenience of being able to use a credit card to make purchases.

- Reduced risk of fraud: Credit cards offer merchants a number of fraud protection features, such as fraud detection software and fraud prevention training for employees.

How to Reduce Processing Fees

There are a number of ways that merchants can reduce processing fees, including:

- Negotiating with the credit card company: Merchants can negotiate with the credit card company to get a lower processing rate.

- Using a third-party processor: Merchants can use a third-party processor to process their credit card transactions. Third-party processors often offer lower processing rates than credit card companies.

- Accepting only certain types of credit cards: Merchants can accept only certain types of credit cards, such as debit cards or business credit cards. Debit cards and business credit cards typically have lower processing rates than consumer credit cards.

What is the processing fee for credit cards?

If you’ve ever swiped or inserted your credit card to make a purchase, you’ve likely noticed a processing fee added to your bill. But what exactly is this fee, and why do businesses charge it? Let’s delve into the world of credit card processing fees and uncover their purpose and impact.

How is the Processing Fee Determined?

The processing fee is a percentage of the transaction amount that a merchant pays to the credit card processor. This fee covers the costs of processing the transaction, including authorization, settlement, and fraud prevention. Several factors influence the processing fee, including:

1. **Type of credit card:** Different credit card networks (e.g., Visa, Mastercard, American Express) have different processing fees. Premium cards or rewards cards often come with higher fees.

2. **Transaction amount:** The processing fee is typically a percentage of the transaction amount. So, larger transactions incur higher fees.

3. **Merchant’s relationship with the credit card processor:** Merchants who have a long-standing relationship with a processor may negotiate lower fees.

4. **Interchange fees:** These are fees paid by the issuing bank (the bank that issued the credit card) to the acquiring bank (the bank that processes the transaction for the merchant). Interchange fees vary based on the type of card and transaction.

5. **Assessment fees:** These are fees charged by credit card networks to cover the costs of operating the network and providing fraud protection.

6. **PCI compliance fees:** Merchants must maintain compliance with the Payment Card Industry Data Security Standard (PCI DSS) to protect cardholder data. Compliance fees may apply.

7. **Chargeback fees:** These are fees charged to merchants when a customer disputes a transaction and requests a chargeback. Chargeback fees can be significant, so it’s essential to have a clear chargeback policy.

The processing fee structure can vary widely among credit card processors and merchants. It’s important to compare fees and negotiate the best possible rates to minimize transaction costs.

What is a Processing Fee for Credit Cards?

Whenever you swipe your plastic, a processing fee is the tollbooth you pay to the credit card companies to complete the transaction. It’s a bit like the charge for using the bridge that connects the buyer and the seller. But what exactly do you pay for when you pay a processing fee?

What are the Different Types of Processing Fees?

The credit card processing fee structure is akin to a complex symphony, with several instruments playing their individual melodies. Let’s break down each type of fee:

Interchange Fee

Consider the interchange fee as the backbone of the processing fee orchestra. It’s the fee paid by the merchant’s bank to the card-issuing bank. Just like the tollbooth on a highway, this fee compensates the credit card company for its services, such as fraud protection and dispute resolution.

Network Fee

The network fee, on the other hand, is akin to the conductor of the processing fee symphony. This fee goes to the payment networks, such as Visa or Mastercard. They ensure a seamless and secure flow of transactions by facilitating communication between the banks involved.

Acquirer Fee

Think of the acquirer fee as the fee charged by the merchant’s bank, often referred to as the payment processor. It covers the merchant’s account maintenance, transaction processing, and chargeback handling.

Other Fees

In addition to these main fees, there may be additional charges unique to the merchant’s account or the specific transaction, such as:

- Chargeback fee: This is a penalty fee charged to the merchant when a customer disputes a transaction and files a chargeback.

- Retrieval fee: This is a fee for retrieving transaction details on behalf of the merchant or the customer.

- Cross-border fee: This is a fee applied to transactions involving different currencies or countries, covering the additional costs of currency conversion and international processing.

- PCI compliance fee: This is a fee applied to merchants who need extra support in meeting the Payment Card Industry Data Security Standard (PCI DSS) requirements.

What is Credit Card Processing Fee?

When you make a purchase with a credit card, the merchant you’re buying from has to pay a fee to the credit card issuer. This fee is called a processing fee, and it covers the cost of processing the transaction. Processing fees can vary depending on the type of credit card used, the amount of the purchase, and the merchant’s agreement with the credit card issuer.

In general, processing fees range from 1% to 3% of the purchase amount. For example, if you make a $100 purchase with a credit card that has a 2% processing fee, the merchant will have to pay $2 to the credit card issuer.

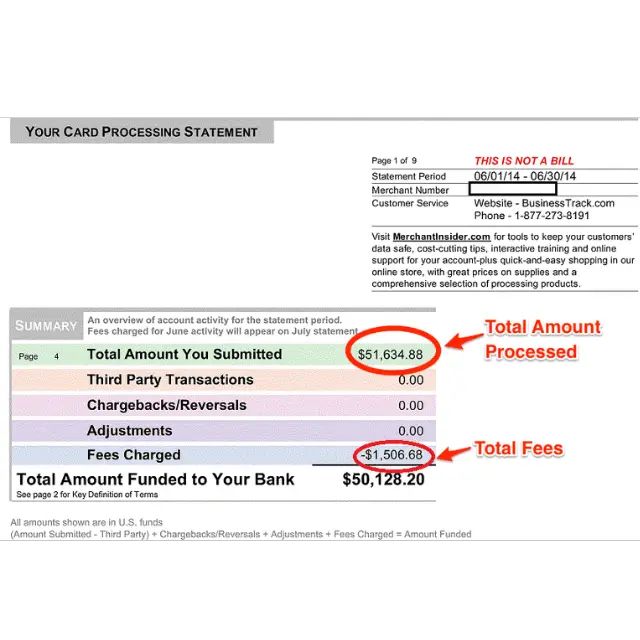

Processing fees can add up quickly, especially for businesses that process a lot of credit card transactions. For example, a business that processes $1 million in credit card transactions per year could pay up to $30,000 in processing fees.

How Processing Fees Work?

Processing fees are typically charged by the credit card issuer to the merchant who accepts the card. The fee is a percentage of the transaction amount, and it is typically between 1% and 3%. For example, if you make a $100 purchase with a credit card that has a 2% processing fee, the merchant will pay $2 to the credit card issuer.

Processing fees cover the cost of processing the transaction, including the cost of authorization, clearing, and settlement. Authorization is the process of verifying that the cardholder has sufficient funds to cover the purchase. Clearing is the process of transferring the funds from the cardholder’s account to the merchant’s account. Settlement is the process of finalizing the transaction and ensuring that the funds are transferred to the merchant’s account.

Types of Processing Fees

There are a number of different types of processing fees, including:

- Flat fees: Flat fees are a fixed amount that is charged per transaction, regardless of the amount of the transaction. For example, a merchant may pay a flat fee of $0.25 for each credit card transaction.

- Percentage fees: Percentage fees are a percentage of the transaction amount. For example, a merchant may pay a 2% processing fee on each credit card transaction.

- Tiered fees: Tiered fees are fees that are based on the type of credit card used. For example, a merchant may pay a lower processing fee for transactions made with basic credit cards and a higher processing fee for transactions made with premium credit cards.

- Interchange fees: Interchange fees are fees that are charged by the credit card issuer to the bank that issued the cardholder’s card. Interchange fees are typically a percentage of the transaction amount, and they can range from 0.5% to 2%. For example, a merchant may pay a 1% interchange fee on each credit card transaction.

- Assessment fees: Assessment fees are fees that are charged by the credit card network (such as Visa, MasterCard, or American Express) to the merchant. Assessment fees are typically a percentage of the transaction amount, and they can range from 0.1% to 0.25%. For example, a merchant may pay a 0.2% assessment fee on each credit card transaction.

How to Reduce Processing Fees

There are a number of ways to reduce processing fees, including:

- Negotiate with your credit card processor: You can try to negotiate with your credit card processor to get a lower processing fee. If you process a large volume of transactions, you may be able to get a better deal.

- Use a payment gateway: A payment gateway can help you to reduce processing fees by consolidating your transactions and negotiating lower rates with credit card processors.

- Offer discounts for cash payments: Offering discounts for cash payments can encourage customers to use cash instead of credit cards, which can help you to reduce processing fees.

- Use a credit card with low processing fees: Some credit cards have lower processing fees than others. If you use a credit card with low processing fees, you can save money on each transaction.

- Process transactions in batches: If you process transactions in batches, you can reduce the number of transactions that you need to process, which can help you to reduce processing fees.

For example, instead of processing each transaction as it comes in, you could process all of the transactions for the day at the end of the day. This can help you to reduce processing fees by up to 50%.

When you process transactions in batches, you can also take advantage of batch discounts. Batch discounts are discounts that are offered by credit card processors to merchants who process a certain number of transactions per month.

For example, a credit card processor may offer a 0.5% discount on processing fees for merchants who process more than 100 transactions per month.