Nationwide Life & Annuity Insurance Co.: A Comprehensive Guide

Nationwide Life & Annuity Insurance Co., a renowned provider in the insurance sector, boasts a diverse portfolio of products tailored to meet the needs of individuals and families nationwide. This article delves into the company’s offerings, unpacking the nuances of life insurance, annuities, and disability income insurance to empower you with informed financial decisions.

Product Offerings

Nationwide Life & Annuity Insurance Co.’s product suite encompasses various insurance solutions, catering to diverse risk profiles and financial goals.

Life Insurance

Life insurance acts as a financial safety net, ensuring that loved ones are cared for in the unforeseen event of your passing. Nationwide offers a spectrum of life insurance options, each tailored to specific needs and circumstances.

Term Life Insurance: This straightforward policy provides a death benefit for a set period (term), typically ranging from 10 to 30 years. It offers affordable coverage with a simple structure.

Whole Life Insurance: As its name suggests, whole life insurance provides lifelong protection with a death benefit. It accumulates cash value over time, which can be borrowed against or withdrawn for various needs.

Universal Life Insurance: Universal life insurance offers flexibility in both coverage and premiums. It allows you to adjust the amount of coverage and premium payments within specified limits, making it suitable for changing financial circumstances.

Variable Life Insurance: Variable life insurance combines life insurance coverage with investment options. The cash value portion is invested in a sub-account, exposing you to potential growth while also carrying market risk.

Annuities

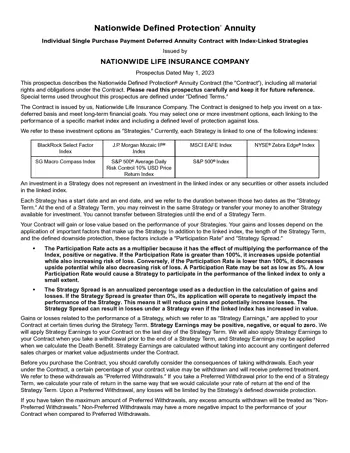

Annuities are financial instruments designed to provide a stream of income in retirement. Nationwide offers a variety of annuity products to cater to different income needs and risk tolerances.

Fixed Annuities: These annuities guarantee a fixed rate of return over a specific period. They offer stability and predictability in income generation.

Variable Annuities: Variable annuities offer the potential for growth through investment options. However, they also expose you to market fluctuations, meaning your income may vary depending on market performance.

Indexed Annuities: Indexed annuities provide a balance between safety and growth potential. They are linked to an external index (e.g., S&P 500) and offer both downside protection and the potential for higher returns based on index performance.

Disability Income Insurance

Disability income insurance replaces a portion of your income if you’re unable to work due to an accident or illness. It provides financial security during periods of unexpected income loss.

Short-Term Disability Insurance: This coverage provides income for a limited period, typically up to 26 weeks. It is designed for temporary disabilities, such as injuries or short-term illnesses.

Long-Term Disability Insurance: Long-term disability insurance offers protection for a more extended period, usually up to 5 or 10 years. It provides income replacement for extended disabilities that prevent you from returning to work.

Choosing the Right Product

Selecting the appropriate insurance product hinges on your individual circumstances, financial goals, and risk tolerance. A financial professional can guide you through this decision-making process, ensuring you secure the coverage that aligns with your specific needs.

Conclusion

Nationwide Life & Annuity Insurance Co. is a reputable provider with a comprehensive product portfolio. Whether you’re seeking peace of mind through life insurance, a secure income in retirement, or protection against income loss due to disability, Nationwide offers tailored solutions to empower your financial well-being. By understanding the nuances of each product, you can make informed decisions to safeguard your future and provide for those you care about.