What is an Insurance Quote?

Imagine you’re planning a road trip and need to fill up your gas tank. You pull up to the pump, and the price per gallon is displayed right there on the sign. That price is an estimate of how much it will cost you to fill your tank. An insurance quote works in much the same way. It’s an estimate of the cost of your insurance policy. Just like the gas price can vary depending on factors like the type of gas and your location, the cost of your insurance policy can vary depending on factors like your age, health, and driving history.

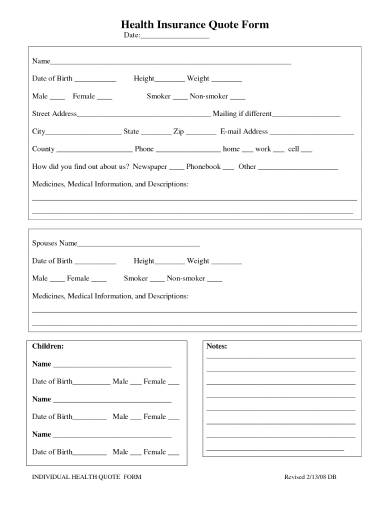

To get an insurance quote, you’ll need to provide some basic information to the insurance company. This typically includes your name, address, date of birth, and details about your driving history. The insurance company will then use this information to calculate your premium, which is the amount you’ll pay for your policy.

Getting an insurance quote is a quick and easy way to compare prices from different insurance companies. It’s a good idea to get quotes from several different companies before you make a decision. This will help you find the best coverage at the best price.

What Factors Affect the Cost of an Insurance Quote?

The cost of your insurance quote will be based on a number of factors, including:

How to Get an Insurance Quote

Getting an insurance quote is quick and easy. You can get a quote online, over the phone, or through an insurance agent.

To get a quote online, simply visit the website of an insurance company and fill out a quote form. You will need to provide some basic information, such as your name, address, and date of birth. The insurance company will then use this information to calculate your premium.

To get a quote over the phone, call an insurance company and speak to a customer service representative. The representative will ask you some questions about your driving history and other factors that affect the cost of insurance. The representative will then calculate your premium and provide you with a quote.

To get a quote through an insurance agent, contact an insurance agent in your area. The agent will meet with you to discuss your insurance needs and provide you with a quote.

How to Compare Insurance Quotes

Once you have received quotes from several different insurance companies, it’s important to compare them carefully before making a decision. Here are a few things to consider when comparing quotes:

Conclusion

Getting an insurance quote is a quick and easy way to compare prices from different insurance companies. By following the tips in this article, you can find the best coverage at the best price.

Insurance Quote Health: A Comprehensive Guide to Securing Your Health Coverage

Navigating the labyrinthine world of health insurance quotes can be a daunting task. But, with the right guidance, you can emerge from the process with a clear understanding of your options and the confidence to make an informed decision. This article will serve as your compass, providing a comprehensive roadmap to obtaining an insurance quote that aligns with your health needs and financial constraints.

Understanding Health Insurance Quotes

Simply put, a health insurance quote is an estimate of the monthly premium you’ll pay for coverage. It encompasses the services and benefits provided by the policy, such as doctor visits, hospital stays, and prescription medications. The premium is calculated based on factors like your age, location, health history, and the specific plan you choose.

How to Get an Insurance Quote

Contacting an Insurance Company or Agent

The most straightforward route to obtaining a health insurance quote is through direct contact with an insurance provider or agent. This can be done via phone, email, or in-person at their office. They will guide you through the application process and provide you with an estimate of the premium based on the information you supply.

Shopping Around for Quotes

Don’t limit yourself to a single quote. It’s crucial to compare rates from multiple providers to ensure you’re getting the best deal. Many online platforms allow you to compare quotes from various insurers side-by-side, simplifying the process.

Understanding Your Coverage Options

Health insurance policies come in a variety of shapes and sizes. The most common types include:

- Health Maintenance Organizations (HMOs): HMOs typically offer lower premiums but require you to see a designated network of healthcare providers.

- Preferred Provider Organizations (PPOs): PPOs allow you to choose any provider you like, but the out-of-pocket costs may be higher.

- Point-of-Service (POS) Plans: POS plans offer a blend of HMO and PPO features, with lower premiums for staying within the network and higher costs for services outside it.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs, but they don’t offer any out-of-network coverage.

- Catastrophic Health Plans: These plans have high deductibles but offer low monthly premiums. They are designed for individuals who are relatively healthy and can afford to pay for most medical expenses out-of-pocket.

Factors that Affect Health Insurance Premiums

Several factors influence the cost of health insurance premiums, including:

- Age: Premiums tend to increase with age as the likelihood of health problems rises.

- Location: Healthcare costs vary across regions, so premiums will reflect these differences.

- Health History: Individuals with pre-existing conditions or chronic illnesses may face higher premiums.

- Tobacco Use: Smokers typically pay higher premiums than non-smokers due to the increased risk of health problems.

- Plan Type: The type of health insurance plan you choose (e.g., HMO, PPO) will impact the premium.

- Deductible: A higher deductible lowers the monthly premium, but it also means you’ll pay more out-of-pocket before the insurance coverage kicks in.

- Coinsurance: Coinsurance is the percentage of healthcare costs you pay after meeting the deductible. A higher coinsurance percentage means lower premiums.

Finding the Right Plan for Your Needs

The key to finding the right health insurance plan is to assess your health needs and financial situation. Consider your expected healthcare utilization, your risk tolerance, and your budget. If you have a chronic condition, you may need a plan with lower deductibles and coinsurance. If you’re relatively healthy, a high-deductible plan may save you money.

Additional Tips for Getting the Best Quote

- Be honest about your health history on the application.

- Explore group health insurance plans if available through your employer or professional organizations.

- Consider negotiating with the insurance provider to reduce premiums if you have a good claims history.

Securing the right health insurance quote is essential for safeguarding your health and financial well-being. By understanding the process, comparing quotes, and considering your specific needs, you can navigate the complexities of health insurance and emerge with a plan that meets your requirements and gives you peace of mind.

If you’re like most people, you probably don’t think about health insurance until you need it. But when you do, it’s important to know how to get the best possible coverage at the best possible price. Click here to get your free health insurance quote today.

What Information Do I Need to Get an Insurance Quote?

You will need to provide information about yourself, your health, and your lifestyle. This information will be used to determine your risk of developing health problems and to calculate your premium. The more information you can provide, the more accurate your quote will be.

What Information Do I Need to Provide About Myself?

You will need to provide basic information such as your name, address, date of birth, and gender. You will also need to provide information about your marital status, employment, and income.

What Information Do I Need to Provide About My Health?

You will need to provide information about your current health status, as well as your medical history. This information will include your height, weight, and blood pressure. You will also need to provide information about any current or past health conditions, as well as any medications you are taking.

What Information Do I Need to Provide About My Lifestyle?

Your health insurance coverage will also reflect your lifestyle and your daily habits. This information may include your smoking status, alcohol consumption, and exercise habits. You will also need to provide information about your family history of health problems.

Here are some additional tips for getting the best possible health insurance quote:

Be honest and accurate when providing information. The more information you can provide, the more accurate your quote will be. Don’t try to hide any health conditions or lifestyle habits, as this could lead to your coverage being denied or your premiums being higher.

Shop around and compare quotes from multiple insurers. Don’t just go with the first insurer you find. Take the time to compare quotes from multiple insurers to make sure you’re getting the best possible deal.

Ask about discounts. Many insurers offer discounts for things like being a non-smoker, being in good health, or having a healthy lifestyle. Be sure to ask about any discounts that you may qualify for.

Read the fine print. Before you sign up for a health insurance plan, be sure to read the fine print carefully. This will help you understand what is and is not covered, as well as any limitations or restrictions that may apply.

Getting the best possible health insurance quote doesn’t have to be difficult. By following these tips, you can make sure you’re getting the coverage you need at a price you can afford.

Insurance Quote Health: A Comprehensive Guide to Understanding Your Coverage

Insurance quotes for health can vary greatly, and it’s important to understand the factors that influence their cost. By knowing what to expect, you can make informed decisions about your health coverage and ensure you’re getting the best possible deal. Here, we delve into the intricacies of insurance quote health, uncovering the key factors that determine your premium and empowering you to navigate the complexities of healthcare insurance.

What Factors Affect the Cost of My Insurance Quote?

The cost of your insurance quote is not a whimsical number plucked out of thin air. Rather, it’s meticulously calculated based on a number of factors that insurers use to assess your risk level. These factors include:

-

Age: Age is a significant factor in determining your health insurance quote. Younger individuals typically pay lower premiums due to their lower risk of developing health problems. As you age, your premiums may increase to reflect the increased likelihood of needing medical care.

-

Health: Your overall health status plays a crucial role in determining your insurance quote. If you have pre-existing conditions, chronic illnesses, or a history of health issues, you may face higher premiums as insurers perceive you as a higher risk.

-

Lifestyle: Your lifestyle choices can also impact your insurance quote. Factors such as smoking, excessive alcohol consumption, and high-risk activities can lead to increased premiums. Conversely, maintaining a healthy lifestyle with regular exercise, a balanced diet, and a clean driving record can lower your risk and lead to lower premiums.

-

Location: The geographic location where you reside can also affect your insurance quote. Areas with higher healthcare costs, such as urban centers, may have higher insurance premiums compared to rural areas. Additionally, states with stricter regulations or higher levels of uninsured individuals may experience higher premiums.

-

Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your monthly premiums, but it means you’ll have to pay more for healthcare expenses before your insurance starts covering the costs.

-

Coinsurance: Coinsurance is the percentage of medical expenses you are responsible for paying, even after you’ve met your deductible. Selecting a higher coinsurance percentage can reduce your premiums, but it will also increase your out-of-pocket costs for medical care.

Additional Factors to Consider:

Beyond the primary factors outlined above, there are other considerations that can affect your insurance quote health. These include:

-

Family history: If you have a family history of certain health conditions, insurers may assess you with a higher risk level, potentially leading to higher premiums.

-

Occupation: Certain occupations that involve hazardous work or long hours may be considered higher risk, resulting in higher premiums.

-

Marital status: Being married or having dependents can impact your insurance quote due to the perceived increase in healthcare expenses for multiple individuals.

-

Employer contributions: If your employer offers health insurance, their contributions can reduce your monthly premiums, making it more affordable to maintain your coverage.

Understanding the factors that affect your insurance quote health is crucial for making informed decisions about your healthcare coverage. By considering these elements and consulting with your insurance provider, you can find an insurance plan that meets your needs and provides the peace of mind you deserve.

Insurance Quote Health: A Comprehensive Guide to Finding the Best Coverage

Shopping for health insurance can be a daunting task, especially with the plethora of options available. But fret not! We’re here to guide you through the insurance quote health maze, providing you with the knowledge to make an informed decision.

What Is a Health Insurance Quote?

A health insurance quote is an estimate of the monthly premium you’ll pay for a specific health insurance plan. It’s based on various factors, including your age, health history, location, and tobacco use. Obtaining a quote is the first step in finding the right coverage for you.

How Can I Compare Insurance Quotes?

Comparing insurance quotes is crucial to finding the best deal. One of the most convenient ways to do this is through an insurance comparison website. These websites allow you to input your information and receive quotes from multiple insurance providers simultaneously.

When comparing quotes, pay attention to the following factors:

- Monthly premium: This is the amount you’ll pay each month for your coverage.

- Deductible: This is the amount you pay out-of-pocket before your insurance starts covering expenses.

- Coinsurance: This is the percentage of covered expenses you pay after meeting your deductible.

- Out-of-pocket maximum: This is the maximum amount you’ll pay for covered services in a year.

What Information Do I Need to Provide for a Health Insurance Quote?

To obtain a health insurance quote, you’ll need to provide the following information:

- Your age

- Your health history

- Your location

- Your tobacco use

What Are the Different Types of Health Insurance Plans?

There are a variety of health insurance plans available, each with its own benefits and drawbacks. The most common types of plans include:

- Preferred Provider Organization (PPO): PPOs offer a large network of providers, giving you more choice and flexibility.

- Health Maintenance Organization (HMO): HMOs typically have a smaller network of providers, but they offer lower premiums and deductibles.

- Exclusive Provider Organization (EPO): EPOs are similar to HMOs, but they have an even smaller network of providers.

- Point-of-Service (POS): POS plans combine features of PPOs and HMOs, offering a wider network of providers than EPOs but with lower premiums than PPOs.

How Do I Choose the Right Health Insurance Plan for Me?

Choosing the right health insurance plan for your needs can be a challenge. Consider the following factors when making your decision:

- Your budget: How much can you afford to pay for monthly premiums and out-of-pocket expenses?

- Your health needs: If you have any chronic conditions, you’ll need a plan that covers those expenses.

- Your lifestyle: If you prefer to see a variety of providers, you’ll need a plan with a large network.

Additional Tips for Comparing Health Insurance Quotes

In addition to the factors mentioned above, here are a few extra tips to help you compare health insurance quotes:

- Don’t just look at the monthly premium. Be sure to consider the deductible, coinsurance, and out-of-pocket maximum as well.

- Ask about discounts. Many insurers offer discounts for things like bundling your insurance policies or being a member of certain organizations.

- Get a copy of the plan’s summary of benefits and coverage (SBC). This document will provide you with detailed information about what the plan covers.

Shopping for health insurance doesn’t have to be a headache. By following these tips, you can be confident that you’re finding the best coverage for your needs.

Insurance Quote Health: A Comprehensive Guide to Finding the Best Coverage for You

As the healthcare landscape continues to shift, the need for comprehensive health insurance becomes more evident. Finding the best insurance quote that meets your unique needs can be a daunting task, but it’s essential to ensure you’re adequately protected against medical expenses and unforeseen circumstances. Here’s a thorough guide to help you navigate the insurance market and snag the best deal:

How Can I Get the Best Insurance Quote?

Scoring the best insurance quote is as simple as ABC: shop around, compare, and contemplate. Don’t be afraid to explore diverse options. The more you compare, the more likely you are to find a policy that fits your budget and requirements. And remember, don’t rush into a decision; take your time to understand what each quote offers before signing on the dotted line.

Factors to Consider When Choosing Health Insurance

Choosing health insurance is like going on a blind date; you want to make sure it’s a good match. Here are a few key factors to keep in mind:

- Coverage: Make sure the policy covers the essential services and treatments you need, including doctor visits, hospital stays, and prescription drugs.

- Deductible: The deductible is the amount you’ll pay out of pocket before insurance kicks in. Choosing a higher deductible can lower your premium, but it also means you’ll have to shoulder more costs upfront.

- Coinsurance: Coinsurance is a percentage of medical expenses you’re responsible for paying after meeting your deductible. A higher coinsurance rate means you’ll pay more out-of-pocket.

- Premium: The premium is the monthly or annual payment you make for your insurance coverage. Premiums vary depending on your age, health status, and the type of plan you choose.

- Network: Health insurance plans typically have a network of doctors and hospitals that you can use. Check if your preferred healthcare providers are included in the plan’s network.

Where to Get Insurance Quotes

Finding insurance quotes is like going on a treasure hunt. Here are your options:

- Insurance agents: These professionals can provide quotes from multiple insurance companies, making it easier to compare your choices.

- Insurance companies: Contacting insurance companies directly can give you a personalized quote tailored to your needs.

- Online marketplaces: Websites like eHealth and HealthCare.gov allow you to compare quotes from different insurance plans.

Tips to Save Money on Health Insurance

Saving money on health insurance is like finding a diamond in the rough. Here are some tricks:

- Get a high-deductible plan: Choosing a plan with a higher deductible can significantly lower your premium costs.

- Use a health savings account (HSA): HSAs allow you to set aside pre-tax dollars to pay for medical expenses, including insurance premiums.

- Take advantage of employer-sponsored plans: If your employer offers health insurance, it’s typically more affordable than purchasing a plan on your own.