How Much Does a Credit Card Processing Fee Cost?

For business owners, understanding the intricacies of credit card processing fees is paramount. These fees can eat into your profits, so it’s important to know what they are and how to minimize them.

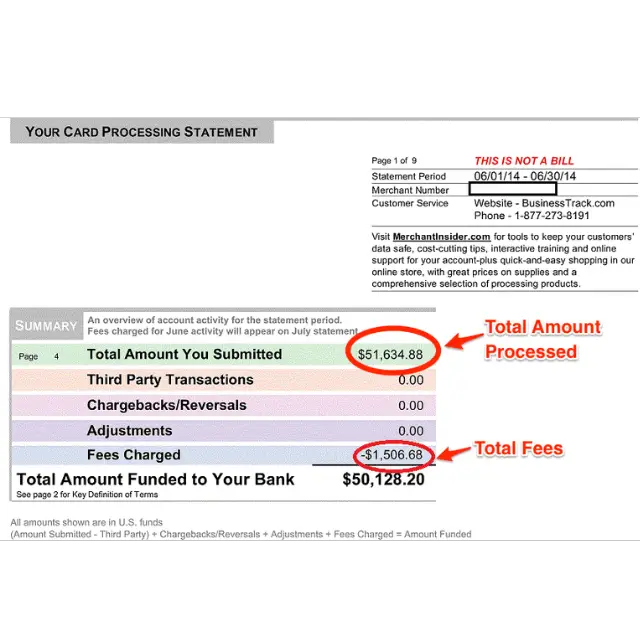

On average, credit card processing fees typically range from 1.5% to 3.5% per transaction, depending on a number of factors, such as the type of card being used, the payment processor you choose, and your business’s volume of transactions. That might not seem like much, but it can add up quickly, especially if your business processes a lot of transactions.

In addition to the standard processing fee, there may also be other fees, such as:

Types of Credit Card Processing Fees

Interchange Fees

Interchange fees are charged by the card-issuing bank to the merchant’s bank. These fees are typically a percentage of the transaction amount, and they vary depending on the type of card being used. For example, interchange fees for Visa and Mastercard are typically around 1.5%, while American Express interchange fees are typically around 2.5%.

Assessment Fees

Assessment fees are charged by the card networks (Visa, Mastercard, etc.) to the merchant’s bank. These fees are typically a fixed amount per transaction, and they vary depending on the card network. For example, Visa assessment fees are typically around $0.10 per transaction, while Mastercard assessment fees are typically around $0.05 per transaction.

Gateway Fees

Gateway fees are charged by the payment gateway to the merchant. These fees are typically a percentage of the transaction amount, and they vary depending on the payment gateway. For example, PayPal gateway fees are typically around 2.9% + $0.30 per transaction.

Other Fees

In addition to the fees listed above, there may also be other fees, such as:

- Chargeback fees

- PCI compliance fees

- Monthly account fees

The specific fees that you will be charged will depend on your business’s individual circumstances. It’s important to shop around and compare different payment processors to find the best deal.

How to Minimize Credit Card Processing Fees

There are a number of things you can do to minimize credit card processing fees, such as:

- Negotiate with your payment processor.

- Choose a payment processor that offers competitive rates.

- Process as many transactions as possible through your own website.

- Use a payment gateway that offers discounts for high-volume merchants.

- Avoid chargebacks.

- Become PCI compliant.

Conclusion

Credit card processing fees are a cost of doing business, but there are a number of things you can do to minimize them. By understanding the different types of fees and shopping around for the best deal, you can save your business money.