Annuity Insurance: A Lifeline for Your Retirement

When you think of retirement, what comes to mind? Visions of sandy beaches, leisurely golf games, and exotic travels often dance in our heads. But underneath these idyllic images lies a fundamental question: how will I sustain my lifestyle without a regular paycheck? Enter annuity insurance, a financial lifeline designed to provide you with a steady stream of income during your golden years.

In essence, annuity insurance is a contract between you and an insurance company. You make a lump-sum payment or a series of payments, and in return, the insurance company guarantees to pay you a fixed amount of money at regular intervals over a specified period, or even for your entire life. It’s like trading a pot of gold for a never-ending stream of golden coins.

Annuities offer several benefits that make them an attractive option for retirement planning. First and foremost, they provide a guaranteed income stream, ensuring you’ll have a steady flow of funds to cover your expenses. No more worrying about market fluctuations or investment risks; your annuity will keep flowing like a steady river, providing a sense of peace and security.

Moreover, annuities offer tax advantages. The earnings on your annuity grow tax-deferred, meaning you don’t pay taxes on them until you start receiving payments. This can lead to significant savings over the long run, especially if you’re in a high tax bracket. It’s like having a secret stash of money that the taxman can’t touch.

But hold your horses there, pardner! Annuities aren’t without their drawbacks. Once you’ve committed to an annuity, it can be difficult to access your money. And if you die before the annuity period ends, your beneficiaries may not receive the full value of your investment. It’s like signing up for a roller coaster ride; once you’re strapped in, there’s no getting off until the ride is over.

Types of Annuities: A Smorgasbord of Options

The world of annuities is a vast and diverse landscape, with different types to suit every taste. Let’s dive into the main categories:

Immediate Annuities: These annuities start paying out almost immediately, providing a quick and reliable source of income. It’s like having a personal ATM machine that dispenses cash at your command.

Deferred Annuities: With deferred annuities, you wait a bit longer for the gravy train to start rolling. These annuities allow your money to grow tax-deferred for a specified period before you start receiving payments. It’s like planting a money tree and watching it sprout and grow over time.

Variable Annuities: These annuities invest your money in a portfolio of stocks, bonds, or other investments. The value of your annuity will fluctuate based on the performance of these investments, offering the potential for higher returns but also carrying more risk. It’s like playing the stock market, but with a safety net.

Fixed Annuities: With fixed annuities, your money is invested in a portfolio of fixed-income investments, such as bonds. The value of your annuity is guaranteed, providing a steady and predictable stream of income. It’s like a cozy blanket on a cold night, offering warmth and comfort.

Indexed Annuities: These annuities combine the stability of fixed annuities with the potential for growth. They offer a minimum guaranteed return, plus additional returns based on the performance of a stock market index, such as the S&P 500. It’s like having your cake and eating it too!

Choosing the Right Annuity: A Match Made in Heaven

Finding the right annuity is like finding your soulmate – it should be a perfect match for your financial goals and risk tolerance. Here are some key factors to consider:

Your Retirement Age: The age at which you plan to retire will determine the type of annuity that’s right for you. If you’re planning to retire soon, an immediate annuity may be a good option. But if you have more time, a deferred annuity can give your money more time to grow.

Your Risk Tolerance: If you’re the type who can’t stand the thought of losing even a penny, a fixed or indexed annuity may be a better choice. But if you’re willing to take on a bit more risk in exchange for the potential for higher returns, a variable annuity could be a good option.

Your Health: If you have health issues that could shorten your life expectancy, an immediate annuity may provide a higher payout over your lifetime. But if you’re in good health, a deferred annuity could give you a longer stream of income.

Your Tax Situation: If you’re in a high tax bracket, a tax-deferred annuity can save you a bundle. But if you’re in a low tax bracket, a taxable annuity may be a better option.

Choosing the right annuity is like choosing a horse for a race. You need to consider your own unique circumstances and pick the one that’s best suited to help you cross the finish line of your retirement goals.

Maximizing Your Annuity: Tips from the Pros

Once you’ve chosen an annuity, there are a few strategies you can use to maximize its benefits:

Shop Around: Don’t settle for the first annuity you come across. Compare quotes from multiple insurance companies to ensure you’re getting the best deal.

Consider Riders: Riders are optional add-ons that can enhance your annuity’s features. For example, you can add a rider that guarantees your payments will continue for a specified period, even if you outlive your life expectancy.

Review Regularly: As your financial situation and goals change, it’s important to review your annuity regularly to make sure it’s still meeting your needs.

Maximizing your annuity is like fine-tuning a race car. By following these tips, you can ensure your annuity is running at peak performance, helping you achieve your retirement dreams.

Conclusion: Your Retirement Lifeline

Annuity insurance is a powerful financial tool that can provide you with a secure and steady stream of income during retirement. By choosing the right annuity and maximizing its benefits, you can create a retirement that’s both comfortable and fulfilling. Remember, it’s never too early to start planning for your golden years. So, saddle up your annuity horse and ride off into the sunset of a secure and prosperous retirement.

Annuity Insurance: A Meaningful Way to Secure Your Future

Have you ever wondered what you’ll live on when you stop working? If so, you’re not alone. Millions of Americans are facing the same question, and many are turning to annuity insurance as a way to secure their financial future.

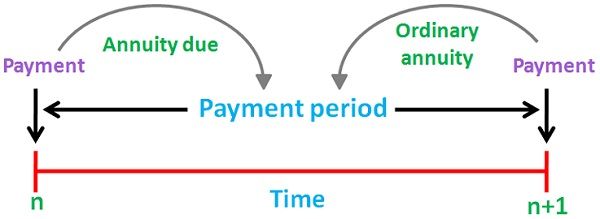

An annuity is a contract between you and an insurance company. You agree to make regular payments into the annuity during your working years, and the insurance company agrees to make periodic payments to you starting at a later date. This can be a great way to supplement your retirement income or provide a steady stream of income in case of unexpected events.

How Annuity Insurance Works

Annuity insurance works on a simple principle: you give the insurance company money now, and they promise to give you money back later. The amount of money you get back depends on several factors, including:

- The amount of money you contribute

- The length of time you contribute

- The type of annuity you choose

There are two main types of annuities: immediate annuities and deferred annuities. Immediate annuities start paying out immediately, while deferred annuities allow you to grow your money tax-deferred until you’re ready to start receiving payments.

Choosing the Right Annuity for You

Choosing the right annuity for you depends on your individual needs and circumstances. If you’re looking for a way to supplement your retirement income, an immediate annuity may be a good option. If you’re younger and want to grow your money over time, a deferred annuity may be a better choice.

Benefits of Annuity Insurance

There are many benefits to annuity insurance, including:

- Guaranteed income: Annuities provide you with a guaranteed stream of income for life, regardless of how long you live. This can give you peace of mind knowing that you’ll always have money to cover your essential expenses.

- Tax-deferred growth: With a deferred annuity, your money can grow tax-deferred until you start receiving payments. This can help you accumulate more money for retirement.

- Death benefit: Many annuities offer a death benefit, which means that your beneficiaries will receive a lump sum payment if you die before you start receiving payments.

Drawbacks of Annuity Insurance

There are also some drawbacks to annuity insurance, including:

- Fees: Annuities can come with fees, so it’s important to compare the fees of different annuities before you purchase one.

- Complexity: Annuities can be complex, so it’s important to make sure you understand the terms and conditions of the annuity before you purchase one.

- Limited flexibility: Annuities are typically less flexible than other retirement savings options, so it’s important to make sure that you’re comfortable with the terms of the annuity before you purchase one.

Is Annuity Insurance Right for You?

Annuity insurance can be a good way to secure your financial future, but it’s not right for everyone. If you’re considering purchasing an annuity, it’s important to weigh the benefits and drawbacks carefully to make sure that it’s the right choice for you.

Here are some questions to ask yourself before purchasing an annuity:

- Do you need a guaranteed stream of income for life?

- Do you want to grow your money tax-deferred?

- Are you comfortable with the fees and complexity of annuities?

- Are you willing to give up some flexibility in exchange for a guaranteed income?

If you answered yes to most of these questions, then annuity insurance may be a good option for you. However, if you’re not sure whether or not an annuity is right for you, it’s always a good idea to talk to a financial advisor to get professional advice.

Annuity Insurance: A Lifeline for Your Financial Future

Annuity insurance is like a financial safety net, protecting you against the uncertainties of life. It’s a contract with an insurance company that guarantees a stream of income for a set period or for your entire life. Think of it as a way to ensure you’ll have a steady source of money, no matter what life throws your way.

Types of Annuities

Types of Annuities

Annuity insurance comes in two main flavors: immediate and deferred. Immediate annuities start paying out immediately, while deferred annuities allow your money to grow tax-deferred until you retire or need the income.

Immediate Annuities: Your Instant Income Stream

Immediate annuities are like having a personal ATM machine. They provide an immediate stream of income, starting as soon as you purchase the annuity. It’s like getting a guaranteed monthly paycheck, no matter what happens in the market or in your life.

Immediate annuities are a great option for retirees or those needing a stable income to cover living expenses. They offer peace of mind knowing you’ll have a consistent flow of cash, even if you outlive your savings or investments.

Deferred Annuities: Your Tax-Sheltered Savings Plan

Deferred annuities are like a secret stash of money that grows tax-free until you need it. You contribute to the annuity over time, and the earnings accumulate without being taxed. When you finally start taking withdrawals, you’ll pay taxes only on the amount you withdraw, not the entire balance.

Deferred annuities are an excellent way to save for retirement or other long-term goals. They allow your money to grow tax-deferred, giving it a head start on inflation and market fluctuations. And when you do start taking withdrawals, you’ll have more control over your tax bill.

Which Annuity Is Right for You?

Choosing the right annuity depends on your financial needs and goals. If you need an immediate income stream, an immediate annuity is a great option. If you’re looking to save for the future, a deferred annuity offers tax-deferred growth.

No matter which type you choose, annuity insurance can provide you with peace of mind and financial security. It’s a way to guarantee a steady stream of income, no matter what the future holds.

Annuity Insurance Meaning: Understanding Your Retirement Lifeline

An annuity insurance is a contract between an insurance company and an individual that provides a guaranteed stream of income for a specified period or for the policyholder’s lifetime. It’s a financial tool designed to turn your retirement savings into a dependable income source, ensuring you don’t outlive your money during your golden years.

Benefits of Annuity Insurance

Annuities offer a wide range of benefits that make them an attractive option for retirement planning. Let’s delve into the key advantages that set annuities apart:

1. Guaranteed Income Stream

The primary benefit of an annuity is its ability to provide a guaranteed income stream during retirement. Unlike withdrawals from a savings account or investments, which fluctuate with market conditions, annuity payments are fixed and reliable. This steady flow of income gives you peace of mind, knowing that you have a predictable source of income to cover your expenses in retirement.

2. Longevity Protection

One of the biggest concerns in retirement is the risk of outliving your savings. Annuities address this risk by providing income for as long as you live, regardless of how long your retirement lasts. This is particularly beneficial for individuals who have a family history of longevity or who are concerned about living a long and expensive life.

3. Tax Advantages

Annuities offer potential tax advantages that can help you maximize your retirement income. When you contribute to an annuity, the earnings grow tax-deferred. This means you don’t pay taxes on the growth until you start receiving income from the annuity. Additionally, you may qualify for tax-free withdrawals from an annuity if you meet certain requirements.

3. Flexibility and Control

Annuities provide you with flexibility and control over your retirement income. You can choose the type of annuity that best suits your needs, such as an immediate annuity that starts paying out right away or a deferred annuity that allows your money to grow tax-deferred for a specified period. Additionally, you can customize your annuity to receive income for a specific period or for your entire lifetime. This flexibility ensures that your annuity aligns with your unique retirement goals.

4. Peace of Mind and Financial Security

Annuities provide peace of mind and financial security in retirement. Knowing that you have a guaranteed income stream can alleviate financial worries and allow you to focus on enjoying your retirement. Annuities also protect your savings from market downturns, ensuring that your retirement income is not subject to the ups and downs of the financial markets.

Additional Considerations

While annuities offer a range of benefits, it’s important to consider some additional factors before purchasing an annuity. Annuities can be complex financial products, so it’s crucial to understand the terms and conditions carefully. Also, annuities may come with fees and charges that can reduce your returns. Lastly, annuities may not be suitable for everyone, so it’s advisable to consult with a financial advisor to determine if an annuity is right for you.

Annuity Insurance: Unveiling Its Meaning and Significance

An annuity insurance, in its essence, is a contract between an insurance company and an individual, where the insurance company promises to make periodic payments to the individual for a specified period or for the rest of their life, in exchange for a lump sum payment or a series of payments made by the individual to the insurance company. These payments serve as a steady stream of income, providing financial security and peace of mind during retirement years or other life stages when income may be limited.

Understanding the Role of Annuity Insurance

Annuity insurance plays a crucial role in financial planning, particularly for individuals seeking guaranteed income during retirement. It offers a sense of stability and predictability in a world where market fluctuations and economic uncertainties can cast a shadow over retirement savings. By converting a lump sum or series of payments into a series of guaranteed payments, an annuity insurance provides a safety net, ensuring a steady flow of income even when other investments may falter.

Types of Annuity Insurance: Exploring the Options

Annuity insurance comes in various forms, each tailored to specific needs and circumstances. Understanding the different types available can help individuals make informed decisions that align with their financial goals.

Immediate annuities: These annuities start making payments immediately after the lump sum is invested. They are ideal for individuals who need immediate income supplementation.

Deferred annuities: Payments with deferred annuities begin at a later date, such as retirement age. They provide an opportunity for individuals to accumulate funds and defer taxes until payments commence.

Fixed annuities: Fixed annuities offer a guaranteed interest rate, ensuring a predictable stream of payments. They are suitable for individuals seeking stability and protection against market volatility.

Variable annuities: Variable annuities invest in market-linked investments, offering the potential for higher returns but also carrying investment risk. They are ideal for individuals with a higher risk tolerance and the potential to earn greater returns.

Considerations for Purchasing Annuity Insurance

Deciding whether an annuity is the right choice for you requires careful consideration of your age, retirement age, life expectancy, and overall financial situation. Here are some key factors to keep in mind:

-

Age: The younger you are when you purchase an annuity, the lower your premiums will be. However, you will also receive payments for a longer period.

-

Retirement age: Consider when you plan to retire and how the annuity payments will supplement your other retirement income sources.

-

Life expectancy: Your life expectancy can impact the duration of annuity payments. If you have a longer life expectancy, you may want to consider an annuity with a longer payout period.

-

Financial situation: Evaluate your overall financial situation, including assets, debts, and cash flow. Annuities can be a valuable tool for individuals who need guaranteed income and have a stable financial foundation.

Delving into the Pros and Cons of Annuity Insurance

As with any financial product, annuities have their own set of advantages and disadvantages. It’s essential to weigh these factors carefully before making a decision.

Advantages:

-

Guaranteed income: Annuities provide a steady stream of income, offering peace of mind and financial security.

-

Tax deferral: Deferred annuities allow for tax-deferred growth of funds until payments commence.

-

Protection against market volatility: Fixed annuities safeguard against market downturns, ensuring a stable income stream.

Disadvantages:

-

Limited flexibility: Annuities typically have surrender penalties for early withdrawals, limiting accessibility to funds.

-

Inflation risk: Fixed annuities may not keep up with inflation over time, potentially eroding the purchasing power of payments.

-

Complexity: Annuity contracts can be complex, making it crucial to understand the terms and conditions before purchasing.

Ultimately, the decision of whether or not to purchase an annuity insurance requires careful consideration of individual circumstances and financial goals. By thoroughly understanding the types available, the factors involved, and the potential benefits and drawbacks, individuals can make informed choices that support their long-term financial security.

Annuity Insurance: A Comprehensive Guide

In the realm of financial planning, annuities emerge as indispensable tools, offering a haven of financial security during retirement’s golden years. An annuity insurance contract is akin to a pact between an individual and an insurance company, where a lump sum is exchanged for a series of guaranteed payments over a predetermined period or even throughout the annuitant’s lifespan.

Types of Annuities

Annuities don’t adhere to a one-size-fits-all approach; instead, they come in various forms, each tailored to distinct financial objectives.

Immediate Annuities:

Immediate annuities, true to their name, commence paying out a steady income stream almost instantly upon purchase. These annuities are ideal for individuals seeking an immediate source of income to supplement their retirement funds.

Deferred Annuities:

Deferred annuities adopt a more patient approach, allowing the accumulated funds to grow tax-deferred until withdrawals commence. This extended growth period maximizes the value of the annuity, making it a prudent choice for long-term financial goals.

Variable Annuities:

Variable annuities introduce an element of market participation, investing the underlying funds in a range of investment options. While this approach offers the potential for higher returns, it also carries the inherent risk associated with market fluctuations.

Fixed Annuities:

Fixed annuities, on the other hand, provide a steady stream of income without the market-related ups and downs. The downside is that they typically offer lower returns compared to variable annuities.

Benefits of Annuities

Annuities are not mere financial instruments; they are veritable lifelines for retirees, offering a myriad of benefits:

Guaranteed Income:

Annuities provide a consistent and guaranteed income stream, irrespective of market fluctuations or economic downturns. This peace of mind is invaluable during retirement, when financial stability is paramount.

Tax Deferral:

Deferred annuities allow for tax-deferred growth, meaning the accumulated funds grow without incurring immediate tax liabilities. This enables the annuity’s value to compound more effectively.

Inflation Protection:

Inflation can erode the purchasing power of savings over time. Annuities, however, offer inflation protection, ensuring that the income stream keeps pace with rising prices, preserving its real value.

Legacy Planning:

Annuities can serve as a valuable estate planning tool. By naming a beneficiary, the annuitant can ensure that the income stream continues after their passing, providing financial support for loved ones.

Drawbacks of Annuities

Annuities are not without their drawbacks, and it’s crucial to be aware of these potential downsides:

Surrender Charges:

Early withdrawals from annuities are often subject to surrender charges, which can be substantial. These penalties discourage premature access to the funds, ensuring the annuity’s long-term viability.

Limited Upside:

Fixed annuities, while offering stability, may not provide the same growth potential as other investments. The trade-off for guaranteed income is potentially lower returns over the long term.

Market Risk:

Variable annuities expose the investor to market fluctuations. While the potential for higher returns exists, so too does the risk of losing some or all of the invested principal.

Annuity Insurance as Part of Financial Planning

Annuities can play a vital role in a comprehensive financial plan, providing a steady income stream and helping individuals achieve their retirement goals. However, it’s essential to carefully consider their benefits and drawbacks to determine if an annuity is the right choice for your unique financial situation. Consulting with a qualified financial advisor is highly recommended to ensure that your annuity aligns with your overall financial objectives.