Low Fee Credit Card Processing: An Overview

In today’s digital age, accepting credit cards has become essential for businesses of all sizes. However, the fees associated with credit card processing can put a significant dent in your profits. That’s where low fee credit card processing comes in. These services offer competitive rates and transparent pricing, helping you keep more of your hard-earned money.

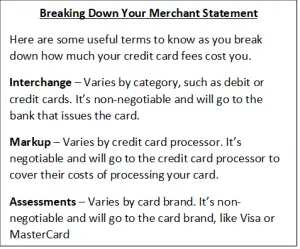

Before diving into the specifics of low fee credit card processing, let’s first understand the basics of payment processing. When a customer swipes their credit card, the transaction is sent to a payment processor. The processor then verifies the card’s validity, checks for sufficient funds, and authorizes the transaction. The processor then sends the funds to your merchant account, minus any applicable fees.

Traditionally, payment processors have charged merchants a percentage of each transaction, known as the discount rate. This rate typically ranges from 1.5% to 3%. Additionally, processors often charge per-transaction fees, such as an authorization fee or a PCI compliance fee. These fees can add up quickly, especially for businesses that process a high volume of transactions.

Low fee credit card processing providers offer a competitive alternative to traditional processors. They typically charge a flat monthly fee, regardless of the number of transactions you process. This can save you a significant amount of money, especially if you process a large number of small transactions.

In addition to lower fees, low fee credit card processing providers also offer a number of other benefits. For example, they often provide free equipment, such as credit card terminals and point-of-sale systems. They also offer 24/7 customer support to help you resolve any issues that may arise.

If you’re looking to save money on credit card processing fees, low fee credit card processing is a great option. These services offer competitive rates, transparent pricing, and a number of other benefits. Contact a low fee credit card processing provider today to learn more.

Low Fee Credit Card Processing: A Comprehensive Guide

In today’s fiercely competitive market, businesses are constantly on the lookout for ways to streamline their operations and maximize profits. One such area where businesses can make significant savings is credit card processing fees. Enter low fee credit card processing—a solution that has gained immense popularity among merchants.

This article will delve into the intricacies of low fee credit card processing, exploring its benefits, potential drawbacks, and how to find the right provider for your business. Whether you’re a seasoned e-commerce veteran or just starting your entrepreneurial journey, this comprehensive guide will provide you with the essential knowledge you need to make informed decisions about your credit card processing needs.

Benefits of Low Fee Credit Card Processing

Low fee credit card processing offers a myriad of advantages to businesses, including:

-

Reduced Operating Costs: One of the most significant benefits of low fee credit card processing is its ability to help merchants reduce their overall operating costs. By eliminating exorbitant processing fees, businesses can redirect those savings towards other critical areas such as inventory, marketing, or employee compensation.

-

Increased Profit Margins: By paying lower processing fees, businesses can increase their profit margins. This is especially crucial for small businesses and startups with limited resources. Every dollar saved on processing fees translates into a direct increase in profitability.

-

Improved Cash Flow: Low fee credit card processing can also significantly improve a business’s cash flow. When processing fees are lower, businesses have more working capital at their disposal, allowing them to invest in growth opportunities and weather economic downturns.

How to Find the Right Low Fee Credit Card Processing Provider

Choosing the right low fee credit card processing provider is crucial for maximizing the benefits outlined above. Here are a few key factors to consider:

-

Transaction Fees: The transaction fee is the primary cost associated with credit card processing. It is important to compare the transaction fees of different providers to find the lowest rates.

-

Monthly Fees: Some providers charge a monthly fee, regardless of the number of transactions processed. If you plan on processing a low volume of transactions, consider opting for a provider with no monthly fee.

-

Equipment Costs: If you need to purchase or rent credit card processing equipment, factor in these costs when comparing providers.

Tips for Negotiating Low Fee Credit Card Processing Rates

Negotiating low fee credit card processing rates can be a daunting task, but it is possible with the right approach:

-

Be Prepared: Gather data on your current processing volume and fees, and be prepared to present it to potential providers.

-

Shop Around: Contact multiple providers and compare their rates and fees. Don’t be afraid to negotiate and ask for the best possible deal.

-

Leverage Your Business Size: If you have a large business with a high processing volume, you may be able to negotiate lower rates.

Conclusion

Low fee credit card processing is a valuable tool for businesses looking to reduce costs, increase profits, and improve cash flow. By understanding the benefits and factors to consider when choosing a provider, you can make informed decisions that will positively impact your business’s financial performance. Remember, every dollar saved on processing fees is a dollar reinvested in the growth and success of your enterprise.

Low-Fee Credit Card Processing: A Guide for Merchants Seeking Savings

In today’s competitive business landscape, every dollar counts. Credit card processing fees can eat into your profits, but don’t let them! With the right approach, you can slash these expenses and boost your bottom line. Low-fee credit card processing providers offer a lifeline for merchants looking to save. These providers understand the pain points of businesses and provide tailored solutions to keep fees minimal.

Why You Should Care About Credit Card Processing Fees

You swipe your credit card, and the transaction goes through seamlessly. But behind the scenes, a complex system of fees and charges is at play. Credit card processing companies charge businesses a percentage of each transaction, which can quickly add up. These fees eat into your profit margin, reducing your ability to invest in growth and innovation.

How to Find a Low-Fee Credit Card Processor

Not all credit card processors are created equal. Choosing the right provider for your business is crucial for maximizing savings. Here are a few key factors to consider when shopping for a low-fee credit card processor:

- Pricing Structure: Look for providers that offer transparent and competitive pricing structures. Avoid hidden fees and opt for flat-rate or interchange-plus pricing models.

- Customer Service: A reliable credit card processor with excellent customer support can help you navigate the complexities of processing and resolve issues promptly.

- Security Measures: Ensure your processor adheres to industry-leading security standards to protect your business and your customers’ data.

- Reputation: Read online reviews and testimonials to gauge the provider’s reliability and track record of success.

- Integration Options: Find a processor that seamlessly integrates with your existing business systems, streamlining your operations and saving time.

Additional Ways to Reduce Credit Card Processing Fees

Signing up with a low-fee credit card processor is a great start, but there are other strategies you can implement to further reduce your costs. Here’s how:

Interchange-Plus Pricing

Interchange-plus pricing is a fee structure that separates the interchange fee charged by the credit card network from the processor’s markup. This transparent approach allows you to see exactly what you’re paying for and gives you more control over your costs.

Optimizing Payment Methods

Not all payment methods are created equal when it comes to fees. Encourage customers to use debit cards or ACH payments, which typically have lower processing fees than credit cards. You can also offer discounts for cash payments to further incentivize customers to choose low-cost options.

Reducing Chargebacks

Chargebacks occur when a customer disputes a transaction and requests a refund. These can be costly for merchants, as they often incur a fee in addition to the loss of revenue. Minimizing chargebacks is crucial for keeping your processing fees low. Implement clear policies, provide excellent customer service, and use fraud prevention tools to reduce the likelihood of disputes.

Negotiation

Don’t be afraid to negotiate with your credit card processor. If you’re a loyal customer with a good payment history, you may be able to secure a better deal. Be prepared to provide data to support your request, such as your processing volume and chargeback rate.

Leverage Technology

Technology can be a powerful tool for reducing credit card processing fees. Use payment gateways that offer bulk processing options to save on per-transaction costs. Integrate with accounting software to automate payment reconciliation and reduce errors that can lead to chargebacks.

Conclusion

Managing credit card processing fees is an essential part of any business’s financial strategy. By following these tips, you can find a low-fee credit card processor and implement strategies to reduce your costs even further. Don’t let excessive fees drain your profits. Take control of your expenses and unlock the potential of your business today.