Annuity Contract Life Insurance: A Comprehensive Guide

An annuity contract life insurance policy is a hybrid financial product that combines life insurance coverage with a savings component. This unique combination offers a guaranteed income stream for a specified period or the policyholder’s lifetime, providing both financial protection and long-term security. This comprehensive guide will delve into the intricacies of annuity contract life insurance, exploring its benefits, drawbacks, and suitability for different financial scenarios.

Understanding Annuity Contracts

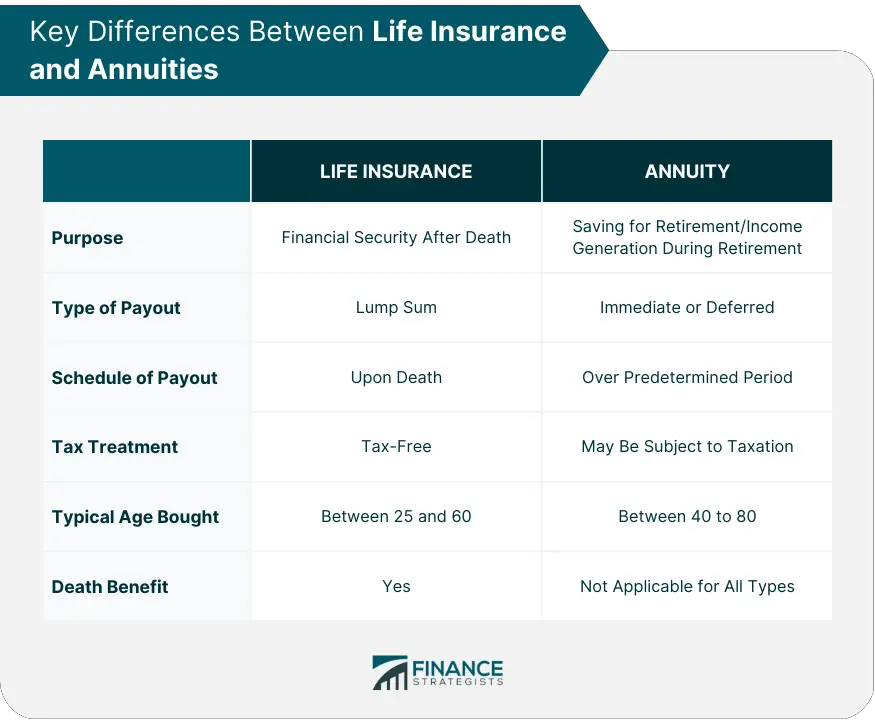

An annuity contract is a legal agreement between an insurance provider and an individual. Under this contract, the insurance company guarantees a series of regular income payments to the policyholder for a predetermined period or the rest of their life, in exchange for a lump-sum premium payment upfront. The contract specifies the frequency of payments, the amount of each payment, and the duration of the annuity.

Types of Annuity Contracts

There are various types of annuity contracts available, each tailored to specific financial needs and objectives. The two main types are immediate annuities and deferred annuities:

-

Immediate Annuities: As the name suggests, immediate annuities begin paying out income immediately after the premium payment is made. These annuities provide a steady cash flow for individuals who need immediate income supplementation or who are nearing retirement and want to convert their savings into a guaranteed income stream.

-

Deferred Annuities: Deferred annuities allow the policyholder to accumulate savings over time before receiving income payments. Contributions made to a deferred annuity grow tax-deferred, and payments typically commence at a later date, such as retirement age. This type of annuity is suitable for individuals who want to save for the long term and benefit from tax-advantaged growth.

Benefits of Annuity Contract Life Insurance

Annuity contract life insurance offers several advantages:

-

Guaranteed Income: Annuity contracts provide a guaranteed stream of income, ensuring financial stability and peace of mind during retirement or other life transitions.

-

Tax-Deferred Growth: Deferred annuities allow earnings to grow tax-deferred until withdrawals are made. This tax-advantaged feature can significantly boost the growth potential of savings.

-

Death Benefit: Most annuity contract life insurance policies include a death benefit, which provides a lump-sum payment to the beneficiary upon the policyholder’s death.

-

Flexible Income Options: Some annuity contracts offer flexible income options, allowing policyholders to adjust the amount and frequency of payments to meet changing financial needs.

Drawbacks of Annuity Contract Life Insurance

Despite the benefits, annuity contract life insurance also has some drawbacks to consider:

-

Limited Liquidity: Funds invested in an annuity contract are typically less liquid than other investments. Withdrawals before the annuity period begins may be subject to penalties and fees.

-

Early Withdrawal Penalties: If withdrawals are made before the specified age or time frame, penalty fees may apply, reducing the overall value of the annuity.

-

Inflation Risk: Annuity payments are fixed and do not adjust for inflation, which can erode the purchasing power of income over time.

Suitability of Annuity Contract Life Insurance

Annuity contract life insurance is not suitable for everyone. It is an ideal financial solution for individuals who:

- Are nearing retirement and need a guaranteed income stream.

- Have significant savings they want to convert into a tax-advantaged income source.

- Seek financial stability and want to mitigate the risk of outliving their savings.

- Understand and accept the limitations of liquidity and inflation risk associated with annuities.

Conclusion

Annuity contract life insurance can be a valuable financial planning tool for individuals seeking a guaranteed income stream and tax-advantaged savings. However, it is crucial to carefully consider the benefits, drawbacks, and suitability of an annuity contract before making a commitment. By understanding the intricacies of this financial product, individuals can make informed decisions that align with their financial goals and risk tolerance.

Annuity Contract Life Insurance: A Comprehensive Guide to Financial Freedom

In the realm of financial planning, annuity contract life insurance stands out as a formidable ally in the pursuit of long-term financial security. This unique financial instrument seamlessly blends life insurance protection with the potential for wealth accumulation and guaranteed income streams. Dive into this comprehensive guide to unravel the intricacies of annuity contract life insurance and discover how it can empower you to achieve your financial aspirations.

Components of an Annuity Contract Life Insurance Policy

At its core, an annuity contract life insurance policy is a multifaceted financial product that intertwines three essential components:

-

Death Benefit: This component serves as a traditional life insurance policy, providing financial protection for your loved ones in the event of your untimely demise. Upon your passing, a predetermined death benefit is paid to your designated beneficiaries, ensuring their financial well-being.

-

Savings or Investment Component: This component functions as a savings or investment vehicle, allowing you to accumulate wealth over time. A portion of your premium payments is invested in a range of financial instruments, such as stocks, bonds, or mutual funds, with the potential to grow your savings significantly.

-

Annuity: This component is the heart of the annuity contract life insurance policy. It guarantees a steady stream of income payments for a specified period, providing you with a reliable source of income during retirement or other life transitions. The annuity payments are typically fixed, meaning they remain the same throughout the payout period, ensuring consistent cash flow.

The Advantages of Annuity Contract Life Insurance

Now that you understand the inner workings of an annuity contract life insurance policy, let’s delve into the myriad of benefits it offers:

-

Financial Security: With an annuity contract life insurance policy, you can rest assured that your loved ones will be financially protected in the event of your untimely demise. The death benefit ensures that your family can maintain their standard of living and fulfill their financial obligations.

-

Wealth Accumulation: The savings or investment component provides a valuable opportunity to grow your wealth over time. By investing a portion of your premium payments, you harness the power of compounding interest, allowing your savings to snowball and potentially outpace inflation.

-

Guaranteed Income: The annuity component guarantees a steady stream of income for a specified period, providing you with a reliable source of cash flow during retirement or other life transitions. This feature is particularly valuable in uncertain economic times, as it provides peace of mind knowing that you have a consistent income to rely on.

-

Tax Deferral: The savings or investment component typically offers tax-deferred growth, meaning you don’t pay taxes on the earnings until you start withdrawing funds. This tax advantage allows your savings to grow more quickly, maximizing your potential returns.

Who Benefits from Annuity Contract Life Insurance?

Annuity contract life insurance is an ideal financial solution for individuals seeking long-term financial security and wealth accumulation. It is particularly well-suited for those who:

-

Are Approaching Retirement: If you’re nearing retirement age, an annuity contract life insurance policy can provide a guaranteed stream of income to supplement your retirement savings and Social Security benefits. This can help you maintain your desired lifestyle and financial independence.

-

Have Income Gaps: If you have periods of time when you expect to have income gaps, such as between jobs or during retirement, an annuity contract life insurance policy can bridge those gaps and ensure you have a consistent source of income.

-

Seek Tax-Advantaged Investments: If you’re looking for tax-advantaged investment options, the savings or investment component of an annuity contract life insurance policy can help you grow your wealth more quickly by deferring taxes on earnings.

Choosing the Right Annuity Contract Life Insurance Policy

When selecting an annuity contract life insurance policy, it’s crucial to consider your individual circumstances and financial goals. Here are some key factors to keep in mind:

-

Premium Payments: Determine how much you can afford to pay in premiums each year. Premium payments will vary depending on your age, health, and the type of annuity contract life insurance policy you choose.

-

Coverage Amount: Decide how much death benefit you need to provide adequate financial protection for your loved ones. The coverage amount should be sufficient to cover final expenses, outstanding debts, and any ongoing financial obligations.

-

Investment Options: Explore the investment options offered by the annuity contract life insurance policy. Consider your risk tolerance and time horizon when selecting investment options.

-

Payout Options: Determine the payout options available under the annuity contract life insurance policy. You may have the option to receive income payments for a specific period, for your entire life, or for the life of your spouse.

Conclusion

Annuity contract life insurance is a powerful financial tool that can provide long-term financial security, wealth accumulation, and guaranteed income streams. By understanding the components, advantages, and considerations associated with annuity contract life insurance, you can make an informed decision about whether this financial instrument is right for you. Consult with a qualified financial advisor to explore your options and create a customized financial plan that meets your unique needs and goals.

Annuity Contract Life Insurance: A Comprehensive Guide

In today’s labyrinthine financial landscape, seeking stability and security is paramount. Amidst a plethora of insurance products, annuity contract life insurance emerges as a beacon of protection and financial planning. It’s a unique blend of life insurance and annuity, offering a guaranteed stream of income, tax-advantaged savings growth, and customizable coverage tailored to your unique needs. Let’s unfurl the intricacies of annuity contract life insurance, exploring its benefits and unraveling the puzzle of its key components.

Benefits of Annuity Contract Life Insurance

Annuity contract life insurance is a multifaceted financial instrument designed to provide a lifetime income stream while offering tax-deferred savings growth. It’s a boon to those seeking financial security and peace of mind, offering a bevy of advantages that make it a compelling choice.

1. **Guaranteed Income Stream:**

Annuity contract life insurance stands out as a reliable source of lifetime income, irrespective of market fluctuations or economic downturns. Upon annuitization, a portion of the accumulated savings is converted into a steady stream of income, ensuring financial stability during retirement or unforeseen circumstances.

2. **Tax-Deferred Growth:**

Annuity contract life insurance is a tax-deferred investment vehicle, allowing earnings to accumulate without immediate taxation. The tax liability is deferred until withdrawals are made, providing a significant advantage over taxable investments. This tax deferral allows savings to grow exponentially, maximizing your retirement nest egg.

3. **Customizable Coverage:**

Annuity contract life insurance offers unparalleled flexibility, empowering you to tailor coverage to your specific needs. You have the freedom to choose the type of annuity that suits your circumstances, the income payout options, and the timing of income commencement. This customization ensures that your annuity contract life insurance aligns seamlessly with your financial goals and objectives.

Annuity Contracts: A Detailed Guide to Life Insurance

In navigating the complex world of financial planning, understanding annuity contracts can be crucial for securing your financial future. An annuity contract is a contract between you and an insurance company where you make a series of payments in exchange for a guaranteed income stream during your retirement years. But did you know that annuity contracts also offer life insurance benefits? Let’s delve into the world of annuity contract life insurance to uncover its multifaceted advantages.

Annuity Contract Life Insurance: A Comprehensive Overview

Annuity contract life insurance combines the benefits of an annuity contract with life insurance coverage. When you purchase an annuity contract, you essentially purchase a guaranteed stream of income for your retirement. However, with an annuity contract life insurance policy, you also receive a life insurance policy that provides financial protection for your loved ones in the event of your untimely demise. This dual-purpose contract offers peace of mind, knowing that your income and your family’s financial security are taken care of.

Types of Annuity Contract Life Insurance Policies

There are two primary types of annuity contract life insurance policies:

-

Immediate Annuities: These contracts begin providing regular income payments immediately upon purchase. They are suitable for individuals seeking immediate financial support during their retirement.

-

Deferred Annuities: These contracts allow your money to accumulate and grow over time before you start receiving income payments. They are ideal for individuals who plan to continue working during their retirement years or want to maximize their potential return.

Benefits of Annuity Contract Life Insurance

Annuity contract life insurance offers a myriad of benefits, including:

-

Guaranteed Income: Annuity contracts provide a reliable source of income during retirement, ensuring financial security throughout your golden years.

-

Life Insurance Protection: The life insurance aspect of the contract ensures that your loved ones will receive a financial benefit if you pass away before the annuity payments have been fully distributed.

-

Tax Benefits: The income from annuity contracts is typically taxed as ordinary income, but withdrawals made from the contract’s cash value may be tax-free.

-

Inflation Protection: Some annuity contracts offer inflation protection features, which help ensure that your income payments keep pace with the rising cost of living.

-

Peace of Mind: Annuity contract life insurance provides peace of mind, knowing that you and your loved ones are financially protected, both during your lifetime and after your passing.

Customizing Your Annuity Contract Life Insurance Policy

Annuity contract life insurance policies can be customized to meet your specific needs and financial goals. When selecting a policy, consider the following factors:

-

Income Needs: Determine how much income you will need during your retirement to maintain your desired lifestyle.

-

Investment Goals: Consider your risk tolerance and investment preferences when selecting the underlying investments for your annuity contract.

-

Life Insurance Needs: Assess the amount of life insurance coverage you need to protect your loved ones financially.

-

Policy Term: Determine the term of the annuity contract and whether you want it to provide income for a specific period or for the rest of your life.

Conclusion

Annuity contract life insurance is a multifaceted financial tool that provides both income security and life insurance protection. By understanding the different types of policies and customization options available, you can tailor an annuity contract life insurance policy to meet your specific needs and ensure a secure financial future for yourself and your loved ones. Embrace the opportunity to plan for your retirement and protect your family with the many benefits that annuity contract life insurance offers.

Annuity Contract Life Insurance: A Lifeline of Financial Protection

When it comes to securing your loved ones’ financial future, an annuity contract life insurance policy can be a veritable lifeline. This multifaceted insurance product combines the safety of life insurance with the growth potential of an annuity, providing peace of mind and financial stability for you and your beneficiaries.

Understanding the intricacies of annuity contracts is paramount for making an informed decision about this crucial financial instrument. In this comprehensive guide, we delve into the factors to consider when choosing an annuity contract life insurance policy, arming you with the knowledge necessary to protect your loved ones and achieve your financial goals.

Factors to Consider When Choosing an Annuity Contract Life Insurance Policy

1. Amount of Coverage

Determine the level of financial protection you require for your beneficiaries. Consider your current income, expenses, and future financial obligations. The amount of coverage should provide sufficient funds to cover immediate expenses, outstanding debts, and long-term financial needs.

2. Type of Annuity

Annuity contracts come in a variety of flavors, each with its own unique advantages and disadvantages. Fixed annuities offer a guaranteed rate of return, while variable annuities provide the potential for higher returns but carry more risk. Consider your risk tolerance and financial goals when selecting the appropriate type of annuity.

3. Premium Payments

The premium payments for an annuity contract life insurance policy can vary depending on the amount of coverage, the type of annuity, and your age and health. Determine a payment schedule that aligns with your financial situation and long-term goals. Be mindful that skipping or delaying premium payments can jeopardize your coverage.

4. Financial Strength of the Insurance Carrier

Choose an insurance carrier with a solid reputation and financial stability. This ensures that your policy will be honored when you need it most. Research the carrier’s financial ratings, customer reviews, and history of claims handling before making a decision.

5. Additional Considerations

Beyond these core factors, there are a number of additional considerations that can influence your choice of annuity contract life insurance policy:

Payout Options: Determine how you want your beneficiaries to receive the death benefit and the pros and cons of each option, such as a lump sum payment, monthly installments, or a combination of both.

Investment Options: Some annuity contracts offer investment options that allow you to grow the cash value of your policy over time. Consider your investment goals and risk tolerance when selecting these options.

Riders: Riders are optional add-ons that can enhance your coverage and provide additional benefits, such as coverage for terminal illness or the ability to accelerate death benefits. Consider the benefits and costs of each rider carefully.

Beneficiaries: Designate your beneficiaries and decide how you want the policy proceeds to be distributed. Ensure that your beneficiaries are aware of your policy and understand their responsibilities.

Remember, choosing an annuity contract life insurance policy is a significant financial decision. By carefully considering these factors and consulting with a qualified financial advisor, you can secure the financial future of your loved ones and achieve peace of mind for yourself.

Annuities: The Key to Guaranteed Income and Life Insurance Protection

An annuity contract life insurance policy is a powerful tool that offers the best of both worlds: a guaranteed income stream and life insurance. It’s like having a safety net that catches you in case of unexpected events while providing a steady stream of income for your retirement years.

How Does an Annuity Contract Life Insurance Policy Work?

With an annuity contract life insurance policy, you make a single premium payment, which is then invested and grows over time. Once you reach the maturity date, you can choose to receive your payout as a lump sum or as a series of regular payments. The insurance component of the policy provides death benefits to your beneficiaries if you pass away before the maturity date.

Types of Annuity Contract Life Insurance Policies

There are two main types of annuity contract life insurance policies: immediate annuities and deferred annuities. Immediate annuities start paying out income immediately, while deferred annuities allow you to accumulate value over time before taking distributions.

Benefits of Annuities

There are several key benefits to purchasing an annuity contract life insurance policy:

-

Guaranteed income stream: Annuities provide a guaranteed source of income that can help you maintain your lifestyle in retirement or supplement your income if you experience a job loss or other financial hardship.

-

Death benefit: The insurance component of the policy provides a death benefit to your beneficiaries, ensuring that your loved ones are financially protected in case of your untimely death.

-

Tax-deferred growth: The money you invest in an annuity grows tax-deferred, meaning you don’t have to pay taxes on the earnings until you take distributions.

Drawbacks of Annuities

There are also some potential drawbacks to consider before investing in an annuity:

-

Irrevocable contract: Once you purchase an annuity, it’s irrevocable, meaning you cannot withdraw the money penalty-free.

-

Fees: Annuities can come with fees, including surrender charges that you’ll pay if you withdraw your money before the maturity date.

-

Potential loss of value: If the investments in the annuity underperform, you could potentially lose money.

Are Annuities Right for You?

Whether or not an annuity contract life insurance policy is suitable depends on your individual financial circumstances and goals. If you’re looking for a guaranteed income stream, life insurance protection, and tax-deferred growth, an annuity may be a good option for you.

Choosing the Right Annuity

If you decide that an annuity is right for you, selecting the one that’s suitable for your needs is crucial. Here are some factors to consider:

-

Type of annuity: Choose between an immediate annuity for immediate income or a deferred annuity for growth potential.

-

Insurance company: Research different insurance companies to find one with a strong financial history and reputation.

-

Fees: Compare the fees associated with different annuities to minimize potential costs.

Conclusion

Annuities can be a valuable financial planning tool for individuals seeking a guaranteed income stream and life insurance protection. However, before investing in an annuity, understanding its benefits, drawbacks, and different types is essential. By carefully considering your financial goals and choosing the right annuity, you can harness its power to secure your financial future and legacy.