Definition and Overview

Life and annuity insurance are two distinct types of insurance that cater to different financial needs and life stages. Life insurance, as the name suggests, provides financial protection in the unfortunate event of the policyholder’s death. It offers peace of mind, ensuring that loved ones are financially taken care of in the event of a sudden loss.

On the other hand, annuity insurance, a contract between an individual and an insurance company, provides a steady stream of income during retirement years. It helps combat longevity risks and guarantees a regular income flow throughout the golden years. Imagine it as a financial parachute, providing a soft landing into retirement life.

Life Insurance: A Lifeline of Protection

Life insurance provides a financial cushion for your loved ones, shielding them from economic hardships that may arise from your untimely demise. It’s a gift of financial security, a lifeline of protection that ensures their well-being even in the face of life’s uncertainties.

There are various types of life insurance policies to choose from. Term life insurance offers coverage for a specific period, providing peace of mind for a set duration. Whole life insurance, on the other hand, provides lifelong coverage and also accumulates a cash value component that can be borrowed against or withdrawn in the future.

Determining the Right Amount of Coverage

Determining the appropriate amount of life insurance coverage requires careful consideration of your individual circumstances and financial responsibilities. One rule of thumb suggests multiplying your annual income by 10 to 15 to arrive at a suitable coverage amount. However, it’s essential to assess your unique needs, including outstanding debts, mortgage obligations, future education expenses for children, and other financial commitments.

Understanding the Benefits of Life Insurance

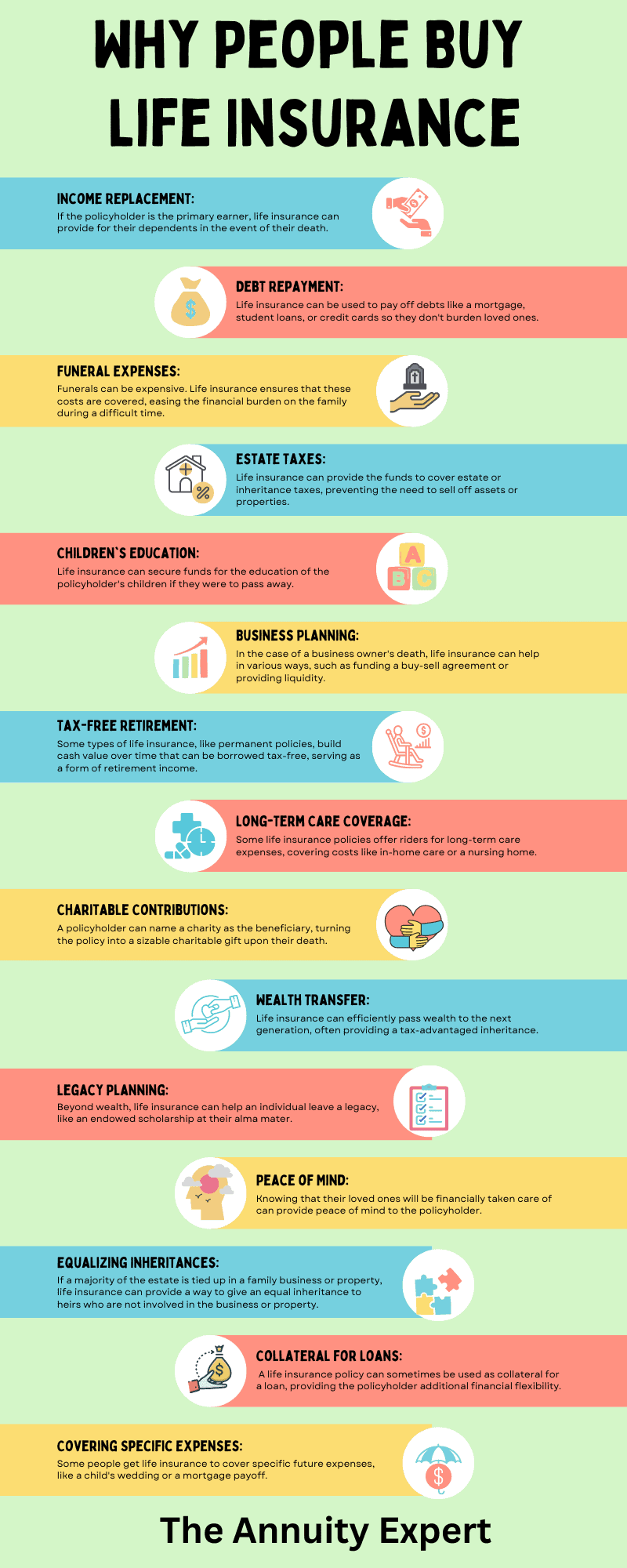

Life insurance offers a multitude of benefits that make it a valuable financial tool. It provides:

-

Peace of Mind: Knowing that your loved ones are financially protected in the event of your passing brings immeasurable peace of mind.

-

Debt Coverage: Life insurance can be used to pay off outstanding debts, such as a mortgage or car loans, alleviating financial burdens for your family.

-

Income Replacement: Life insurance can replace your income, ensuring that your family can maintain their current lifestyle even after you’re gone.

-

Education Funding: Life insurance can help secure your children’s education, ensuring their dreams are not compromised by your untimely demise.

Annuity Insurance: A Guaranteed Income Stream for Retirement

Annuity insurance offers a reliable source of income during retirement, mitigating the risks associated with longevity. It’s like having a personal retirement plan guaranteed by an insurance company. When you purchase an annuity, you essentially exchange a lump sum or series of payments for a stream of income that begins at a specified age, usually during retirement.

Types of Annuities

There are various types of annuities to choose from, each with its own unique features:

-

Immediate Annuities: Begin paying out a fixed income immediately upon purchase, providing a steady cash flow right away.

-

Deferred Annuities: Allow your investment to grow tax-deferred until you retire, at which point you can begin receiving regular income payments.

-

Variable Annuities: Offer the potential for higher returns by investing in stocks and bonds, while also providing the safety of a guaranteed minimum payment.

Considerations for Choosing an Annuity

Selecting the right annuity requires careful consideration of factors such as:

-

Age and Retirement Time Horizon: Consider your current age and the number of years until you plan to retire.

-

Income Needs: Determine your monthly income needs during retirement, taking into account your expenses, lifestyle, and potential sources of income.

-

Risk Tolerance: Assess your comfort level with investment risk and choose an annuity that aligns with your risk tolerance.

-

Tax Implications: Understand the tax consequences of different types of annuities to avoid surprises down the road.

Life and Annuity Insurance: A Comprehensive Guide

When it comes to financial planning, life and annuity insurance are two crucial pillars that provide peace of mind and financial security for you and your loved ones. Let’s delve into each type of insurance and explore their significance, benefits, and considerations.

Life Insurance

Life insurance is a contract that guarantees a death benefit to beneficiaries upon the insured person’s passing. This payout can help loved ones cover funeral expenses, pay off debts, continue education, or maintain their standard of living. Life insurance policies typically fall into two main categories:

1. Term Life Insurance: This type of policy provides coverage for a set period, such as 10, 20, or 30 years. It offers affordable premiums and is ideal for those seeking temporary protection.

2. Permanent Life Insurance: As its name suggests, permanent life insurance provides lifelong coverage. In addition to a death benefit, these policies may also have a cash value component that can grow over time. They offer more flexibility and long-term financial planning options but come with higher premiums.

When purchasing life insurance, it’s essential to consider factors such as the amount of coverage needed, the policy term, and the premium affordability. It’s also wise to consult with a financial advisor to determine the best policy for your specific needs.

Annuity Insurance

An annuity is a financial product designed to provide a stream of income for a specified period or throughout the policyholder’s lifetime. It involves investing a lump sum or making regular payments into the annuity contract. Once the accumulation period ends, the policyholder begins receiving payments based on the terms of the policy.

There are different types of annuities, each with its unique features and benefits:

1. Fixed Annuities: These provide a guaranteed interest rate and predictable payments over the annuity period. The interest rate is typically set at the time of purchase and remains fixed throughout the contract.

2. Variable Annuities: These offer the potential for higher returns by investing in a diversified portfolio of stocks and bonds. However, the value of variable annuities can fluctuate based on market conditions, leading to both potential gains and losses.

3. Immediate Annuities: As the name suggests, these annuities begin paying out income immediately upon purchase. They are typically purchased with a lump sum and provide a guaranteed income stream for a specific period or the policyholder’s lifetime.

4. Deferred Annuities: These allow the policyholder to accumulate funds over time before starting to receive income payments. Deferred annuities can offer tax-deferred growth, potentially allowing the funds to grow faster than they would in a taxable account.

The choice of annuity depends on individual financial goals and risk tolerance. It’s important to understand the different options and consult with a financial advisor to determine the right type of annuity for your needs.

In conclusion, life and annuity insurance are valuable financial tools that can provide protection, security, and financial stability for individuals and families. By understanding the different types of policies available and carefully considering your unique circumstances, you can make informed decisions that help you achieve your long-term financial objectives.

Life and Annuity Insurance: A Comprehensive Guide

In the realm of financial planning, life and annuity insurance stand out as cornerstones of a secure future. These products offer invaluable protection and income for individuals and families alike. Life insurance provides peace of mind, ensuring financial security for loved ones in the event of an untimely demise. Annuity insurance, on the other hand, provides a steady stream of income during retirement years, guaranteeing a stable financial foundation throughout one’s golden years.

Life Insurance

Life insurance is a contract between an insurance company and an individual, known as the policyholder. The policyholder pays premiums to the insurance company, which in turn agrees to pay a death benefit to the policyholder’s beneficiaries upon their demise. The death benefit can be used to cover a variety of expenses, such as final expenses, mortgage payments, and education costs for children. There are various types of life insurance policies available, each with its unique features and benefits. Term life insurance provides coverage for a specific period, while whole life insurance provides lifelong coverage and includes a cash value component that grows over time.

Annuity Insurance

An annuity insurance contract provides regular income payments to the annuitant for a specific period or for life. These payments can be a lifeline during retirement years, ensuring a steady stream of income to cover living expenses. Annuities can be either immediate or deferred. Immediate annuities begin making payments immediately, while deferred annuities allow the annuitant to accumulate funds tax-deferred until a later date. There are also various types of annuities available, such as fixed annuities, variable annuities, and indexed annuities, each with its own unique features and benefits. Fixed annuities provide a guaranteed rate of return, while variable annuities offer the potential for higher returns but also carry more risk. Indexed annuities offer a balance between the two, providing a return that is tied to the performance of a stock market index.

Choosing the Right Life and Annuity Insurance Policies

Choosing the right life and annuity insurance policies is crucial for ensuring financial security throughout life’s journey. Several factors should be considered when making these decisions, such as age, health, financial situation, and retirement goals. It’s always advisable to consult with a qualified financial advisor who can provide personalized guidance and help navigate the complex world of insurance products. Remember, life and annuity insurance are powerful tools that can bring peace of mind and financial stability to individuals and families. By understanding how these products work and making informed decisions, you can create a secure financial foundation that will last a lifetime.

Life and Annuity Insurance: A Comprehensive Guide

Life and annuity insurance are two crucial financial tools that can safeguard your loved ones and ensure your financial well-being in the future. Life insurance provides a financial cushion for your beneficiaries in the event of your untimely demise, while annuities offer a stream of income during your retirement years.

Types of Life Insurance

When choosing a life insurance policy, you’ll encounter several different types, each with its unique coverage and premium structure.

- Term Life Insurance: This is a straightforward and affordable option that provides coverage for a specific period, typically ranging from 10 to 30 years. Once the term expires, you can renew the policy at a higher premium or let it lapse.

- Whole Life Insurance: This type of policy offers lifelong coverage and a cash value component that grows over time. The premiums are typically higher than term life insurance, but the cash value can be used for various purposes, such as a down payment on a house or a child’s education.

- Universal Life Insurance: Universal life insurance combines the flexibility of term life insurance with the cash value component of whole life insurance. It allows you to adjust your coverage amount and premiums as your needs change.

Choosing the Right Life Insurance Policy

Selecting the right life insurance policy depends on several factors, including your age, health, budget, and financial goals. Consider the following tips:

- Determine your coverage needs by estimating the financial obligations you’d want your beneficiaries to cover, such as funeral expenses, debts, and income replacement.

- Compare quotes from multiple insurance providers to find the best combination of coverage and premiums.

- Consider riders such as accidental death and dismemberment (AD&D) and income replacement coverage to enhance your policy’s protection.

- Annuities: A Retirement Income Source

Annuities are financial products that provide a guaranteed stream of income for life or a specified period. They are a popular retirement planning tool that can help you supplement your Social Security benefits and ensure financial stability in your golden years.

Types of Annuities

There are various types of annuities to cater to different financial needs and risk tolerance levels.

- Immediate Annuities: These annuities start paying out income almost immediately after you purchase them. They offer a fixed or variable rate of return and provide guaranteed income for the rest of your life.

- Deferred Annuities: These annuities allow you to accumulate savings over time before starting to receive income. They offer tax-deferred growth and provide a lump sum or stream of income in the future.

- Variable Annuities: These annuities invest your premiums in the stock market, providing the potential for higher returns but also exposing you to market risk.

Choosing the Right Annuity

Selecting the right annuity is crucial for planning a financially secure retirement. Consider the following factors:

- Determine your income needs and the timeframe for which you need the income.

- Choose an annuity type that aligns with your risk tolerance and investment goals.

- Research different annuity providers and compare their rates, fees, and customer service.

Life and Annuity Insurance: A Secure Retirement Plan

Securing a comfortable retirement is paramount, and life and annuity insurance policies play a crucial role in this endeavor. Life insurance safeguards your loved ones financially in your absence, while annuities provide a steady stream of income throughout your golden years. As you plan for the future, understanding the nuances of these insurance products is essential. Dive into the depths of life and annuity insurance, unraveling their intricacies and exploring how they can bolster your retirement strategy.

Types of Annuities

Annuities, like financial chameleons, come in various forms, each tailored to specific needs and risk tolerance. Let’s unmask the three main types:

Fixed Annuities: A Haven of Guaranteed Returns

Fixed annuities resemble a safe haven, providing a guaranteed interest rate for a predetermined period, typically ranging from one to ten years. Think of them as a savings account with a locked-in return, shielding you from market fluctuations. However, the trade-off for this stability is the potential for lower returns compared to variable annuities.

Variable Annuities: Embrace the Market’s Ups and Downs

Variable annuities are more akin to adventurous explorers, venturing into the stock market’s uncharted waters. They offer the potential for higher returns, but this comes with the inherent risk of market volatility. Consider them a rollercoaster ride, with the promise of exhilarating highs but also the potential for stomach-churning lows.

Indexed Annuities: A Hybrid Approach

Indexed annuities strike a delicate balance between stability and growth potential. They link their returns to an index, such as the S&P 500, offering the prospect of higher returns than fixed annuities while mitigating the risk of losing principal.

Annuity Payout Options: Customizing Your Income Stream

Annuities offer a buffet of payout options, allowing you to tailor your income stream to your unique circumstances and financial goals. Let’s explore the main choices:

Immediate Annuities: Instant Gratification

Immediate annuities, like an instant gratification machine, provide an income stream that begins shortly after you purchase the annuity. They’re ideal for those seeking a guaranteed income source to supplement their retirement savings or cover essential expenses.

Deferred Annuities: Tax-Deferred Growth

Deferred annuities, on the other hand, are like a slow-cooker for your savings, allowing them to simmer and accumulate tax-deferred until you’re ready to start receiving income. This tax-advantaged growth can lead to a substantial nest egg down the road.

Variable Annuities: Flexibility and Risk

Variable annuities, with their investment-linked nature, offer flexibility in payout options. You can choose to receive a fixed amount, a variable amount based on the performance of the underlying investments, or a combination of both. However, remember the inherent risk associated with market fluctuations.

Benefits of Annuities: A Lifeline for Retirement Security

Annuities are more than just financial products; they’re lifelines for retirement security. Let’s delve into their myriad benefits:

Guaranteed Income: A Steady Stream of Support

Annuities provide a guaranteed income stream, acting as a safety net against market downturns and ensuring a predictable flow of funds throughout your retirement years.

Tax-Deferred Growth: Supercharging Your Savings

Deferred annuities allow your savings to grow tax-deferred, meaning you won’t pay taxes on the earnings until you start withdrawing them. This tax advantage can significantly boost your nest egg over time.

Inflation Protection: Shielding Your Income

Some annuities offer inflation protection, safeguarding your income stream from the insidious effects of inflation. As the cost of living rises, so does your annuity payment, ensuring your purchasing power remains intact.

Longevity Protection: A Safety Net for Extended Lifespans

With life expectancies on the rise, annuities provide longevity protection, ensuring you won’t outlive your savings. They offer the peace of mind that you’ll have a steady income source no matter how long you live.

Choosing the Right Annuity: A Tailored Solution

Selecting the right annuity is akin to finding the perfect puzzle piece that fits your financial goals. Consider these key factors:

Risk Tolerance: Navigating the Risk-Reward Spectrum

Your risk tolerance plays a pivotal role in choosing an annuity. If you prefer stability and guaranteed returns, fixed annuities may be your haven. Conversely, if you’re willing to embrace market ups and downs in pursuit of higher returns, variable annuities could be your path.

Investment Horizon: A Journey of Time

Your investment horizon, the length of time you plan to invest, influences your annuity choice. Immediate annuities provide immediate income, while deferred annuities offer tax-deferred growth over a longer period. Align your annuity selection with your retirement timeline.

Financial Goals: Mapping Your Financial Roadmap

Your financial goals are the compass guiding your annuity decision. Whether you seek a guaranteed income stream, tax-advantaged growth, or inflation protection, choose an annuity that complements your retirement aspirations.

Life and Annuity Insurance: Navigating the Financial Maze

In the realm of financial planning, life and annuity insurance stand as two pillars of security, offering a lifeline of protection and income in the face of unforeseen circumstances. These policies are not mere financial products; they are the safety nets that safeguard individuals and families from life’s inevitable curveballs.

Benefits of Life and Annuity Insurance

The benefits of life and annuity insurance extend far beyond mere financial cushioning. They provide a comprehensive package of protection and security, including:

- Financial Security: These policies provide a lump sum payout upon the death of the insured, ensuring financial stability for loved ones left behind.

- Income Replacement: Annuities offer a steady stream of income in retirement, providing a reliable source of financial support when traditional sources of income dry up.

- Tax Advantages: Life insurance death benefits are generally tax-free, while annuity withdrawals may be partially tax-free or taxed at favorable rates.

Choosing the right life and annuity insurance policies can be a daunting task. To make informed decisions, it’s crucial to understand the different types of policies available and their specific benefits.

Types of Life Insurance Policies

Life insurance policies come in various forms, each tailored to specific needs:

- Term Life Insurance: Provides coverage for a set period, offering affordable premiums and the flexibility to renew or convert to permanent coverage later on.

- Whole Life Insurance: Provides lifelong coverage, building cash value over time that can be accessed through loans or withdrawals. Premiums are higher than term life insurance, but the policy remains in force as long as premiums are paid.

- Universal Life Insurance: Offers flexibility, allowing policyholders to adjust death benefits and premium payments based on changing needs. Cash value accumulates on a tax-deferred basis.

Choosing the right life insurance policy depends on individual circumstances, risk tolerance, and financial goals.

Types of Annuity Policies

Annuities provide a steady stream of income in retirement, with various types available:

- Immediate Annuities: Begin paying out income immediately upon purchase, providing a guaranteed income stream for a set period or for life.

- Deferred Annuities: Allow for the accumulation of funds over time before payments begin. They offer tax-deferred growth, but withdrawals before the annuity start date may be subject to penalties.

- Variable Annuities: Invest in a portfolio of stocks and bonds, offering the potential for higher returns but also the risk of investment losses.

Choosing the right annuity policy involves balancing the need for income security with the potential for growth and the tolerance for risk.

Factors to Consider When Choosing

When selecting life and annuity insurance policies, it’s essential to consider several factors:

- Needs and Goals: Determine the specific needs for financial security and income in retirement.

- Age and Health: Age and health status impact premiums and the availability of certain policies.

- Risk Tolerance: Assess the ability to withstand investment losses and choose policies that align with the risk tolerance level.

- Cost and Premiums: Compare the costs and premiums of different policies to ensure they fit within the financial budget.

- Tax Implications: Understand the tax implications of life insurance death benefits and annuity withdrawals.

Careful consideration of these factors will lead to informed decisions that align with individual circumstances and financial goals.

Conclusion

Life and annuity insurance policies are not just financial products; they are investments in peace of mind and financial security. By understanding the benefits, types, and factors to consider, individuals can make informed decisions that will provide a safety net for themselves and their loved ones in the face of life’s uncertainties.

Remember, financial planning is not one-size-fits-all. To navigate the complexities of life and annuity insurance, it’s wise to seek guidance from a qualified financial advisor who can provide personalized recommendations based on individual circumstances and goals.

The Ins and Outs of Life and Annuity Insurance: A Guide to Securing Your Financial Future

In today’s uncertain financial landscape, safeguarding our loved ones and securing our retirement is paramount. Life and annuity insurance offer peace of mind by providing financial protection against life’s unexpected events and ensuring a steady stream of income in retirement. Understanding the intricacies of these insurance products is crucial to making informed decisions that align with your unique needs and goals.

What is Life Insurance?

Simply put, life insurance is a contract between you and an insurance company. You pay regular premiums, and in the event of your untimely demise, your beneficiaries receive a predetermined payout. This financial safety net ensures that your loved ones can cover expenses like mortgages, funeral costs, and outstanding debts, easing their burden during a difficult time.

What is Annuity Insurance?

An annuity insurance contract, in essence, provides a guaranteed income stream for life or a specified period. You make a lump-sum payment or a series of payments to the insurance company, and in return, you start receiving regular payments when you reach retirement age or a predetermined time. Annuities offer a stable source of income, reducing the risk of outliving your savings during retirement.

Considerations When Purchasing

When shopping for life and annuity insurance, several factors deserve careful consideration. Age, health, financial goals, and risk tolerance are key elements that influence your insurance needs and the type of coverage that best suits you.

Age

Your age plays a significant role in determining your insurance premiums. Younger individuals generally qualify for lower premiums due to their lower mortality risk. As you get older, the likelihood of health issues increases, leading to higher premiums.

Health

Your overall health status is a crucial factor in underwriting life and annuity insurance policies. Individuals with pre-existing medical conditions may face higher premiums or even limited coverage options. A thorough medical examination may be required to assess your health and determine your risk level.

Financial Goals

Your financial goals and aspirations should drive the amount of life insurance coverage you purchase. Consider your income, debt obligations, dependents, and desired standard of living for your family in your absence. Ensure that the coverage you choose will adequately meet their financial needs.

Risk Tolerance

Your risk tolerance, or how comfortable you are with financial uncertainty, influences the type of insurance coverage you opt for. If you prefer guaranteed returns, annuities may be a suitable option. On the other hand, if you are willing to take on some investment risk, variable annuities may provide the potential for higher returns.

Tax Implications

Life insurance proceeds are generally tax-free, providing a significant financial benefit to your beneficiaries. Annuities, on the other hand, follow different tax rules. The portion of annuity withdrawals that represents principal is tax-free, while the interest portion is subject to income tax.

Riders and Endorsements

Riders and endorsements are additional features you can add to your life or annuity insurance policies to enhance coverage or customize them to your specific needs. For example, a waiver-of-premium rider can help cover your premiums if you become disabled.

Insurance Company Reputation and Financial Strength

When selecting an insurance provider, research their reputation and financial strength. Consider their customer service ratings, claims payment history, and financial stability. Choose a company you can trust to fulfill its obligations and provide reliable protection.