Annuities: A Lifeline of Financial Security in Life’s Uncertain Tides

In the realm of financial planning, annuities stand as a beacon of stability, offering individuals a guaranteed income stream in their golden years. These contracts between an insurance company and an individual provide a safety net, mitigating uncertainties that may arise down the road. Annuities can be bundled alongside life insurance policies, further safeguarding loved ones against life’s unpredictable storms.

Types of Annuities: Exploring the Spectrum of Options

The world of annuities offers a diverse array of choices, each tailored to suit specific financial goals and circumstances. Two primary categories emerge: immediate annuities and deferred annuities.

Immediate Annuities: A Guaranteed Income, Right Here, Right Now

Immediate annuities, as their name suggests, provide an immediate stream of income upon purchase. With this option, individuals can convert a lump sum into a steady flow of payments, ensuring financial stability during retirement. These annuities are particularly suited for those seeking a guaranteed income without delay.

Deferred Annuities: Patience Rewarded with a Growing Nest Egg

Deferred annuities, on the other hand, take a longer-term approach. These contracts allow individuals to accumulate funds over time, with earnings growing tax-deferred until withdrawals begin. Deferred annuities are ideal for those with a longer investment horizon, seeking to maximize their savings for future financial security.

Diving Deep into Deferred Annuities: A Comprehensive Exploration

Deferred annuities, with their focus on long-term growth, present a multifaceted landscape of options. Let’s delve into the specific types and their unique characteristics:

Fixed Annuities: A Steady Climb Towards a Guaranteed Future

Fixed annuities provide a predictable and steady return on investment. With these annuities, the interest rate is locked in for a specified period, shielding individuals from market fluctuations. Fixed annuities are a haven for those seeking stability and a guaranteed growth rate.

Variable Annuities: Embracing the Potential for Higher Returns

Variable annuities, in contrast, offer the potential for higher returns by investing in a range of underlying investments, such as stocks or bonds. However, this potential comes with an element of risk, as market fluctuations can impact the value of the annuity. Variable annuities are better suited for individuals with a higher risk tolerance and a longer investment horizon.

Indexed Annuities: A Hybrid Approach, Balancing Risk and Reward

Indexed annuities strike a balance between the stability of fixed annuities and the growth potential of variable annuities. These annuities are tied to a market index, such as the S&P 500, and provide a return based on the index’s performance, while offering some protection against downside risk. Indexed annuities appeal to those seeking a blend of growth potential and downside protection.

In choosing a deferred annuity, careful consideration of individual financial goals, risk tolerance, and investment horizon is paramount. With a plethora of options available, individuals can tailor an annuity to their specific needs and aspirations.

Annuities and Life Insurance: A Comprehensive Guide

Annuities and life insurance are two financial products that can provide peace of mind and financial security. Annuities offer a guaranteed income stream for life, while life insurance provides a financial safety net for your loved ones in the event of your death. Understanding the benefits and drawbacks of both products is essential for making informed financial decisions.

Benefits of Annuities

Annuities offer a number of benefits, including:

- Guaranteed income for life: Annuities provide a steady stream of income that you can’t outlive. This can be a valuable asset in retirement, when your other sources of income may be limited.

- Tax-deferred growth: The earnings on annuities grow tax-deferred, meaning you don’t pay taxes on them until you withdraw the money. This can significantly increase the value of your investment over time.

- Principal protection: Annuities are backed by the full faith and credit of the insurance company that issues them. This means that your principal investment is protected, even if the insurance company goes bankrupt.

How Annuities Work

There are two main types of annuities: immediate annuities and deferred annuities. Immediate annuities begin paying out income immediately, while deferred annuities allow you to grow your investment tax-deferred for a period of time before starting to receive income.

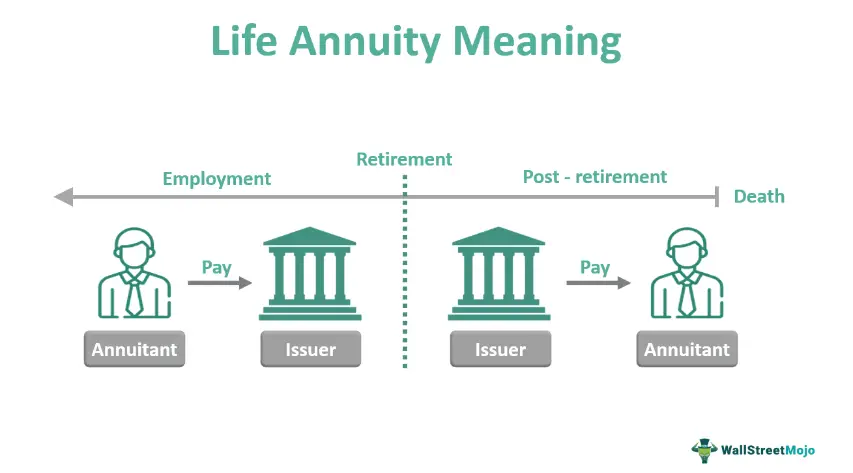

When you purchase an annuity, you make a single premium payment. The insurance company then invests your premium and uses the earnings to pay you income. The amount of income you receive depends on the type of annuity you purchase, the amount of your premium, and the age at which you start receiving income.

Life Insurance

Life insurance provides a financial safety net for your loved ones in the event of your death. When you purchase a life insurance policy, you agree to pay a premium to the insurance company. In return, the insurance company agrees to pay a death benefit to your beneficiaries if you die while the policy is in force.

There are two main types of life insurance policies: term life insurance and whole life insurance. Term life insurance provides coverage for a specific period of time, such as 10 or 20 years. Whole life insurance provides coverage for your entire life.

How Life Insurance Works

When you purchase a life insurance policy, you choose the amount of death benefit you want and the length of time you want the policy to be in force. You also choose the type of policy you want, such as term life insurance or whole life insurance.

The premium you pay for life insurance depends on a number of factors, including your age, health, and the amount of coverage you want. The younger and healthier you are, the lower your premium will be.

Comparing Annuities and Life Insurance

Annuities and life insurance are both valuable financial products that can provide peace of mind and financial security. However, the two products are very different in terms of their purpose and benefits.

Annuities are designed to provide a steady stream of income for life, while life insurance is designed to provide a financial safety net for your loved ones in the event of your death. Which product is right for you depends on your individual needs and financial goals.

If you’re looking for a way to guarantee a steady stream of income for life, then an annuity may be a good option for you. However, if you’re more concerned about providing financial protection for your loved ones, then life insurance may be a better choice.

Annuities and Life Insurance: A Comprehensive Guide

In the realm of financial planning, understanding the intricacies of annuities and life insurance is crucial for securing your future and the well-being of your loved ones. These two financial instruments serve distinct purposes, yet they often complement each other in providing peace of mind and financial stability.

What is Life Insurance?

Life insurance is a contract between you and an insurance company. You pay regular premiums, and in the event of your untimely demise, your beneficiaries receive a death benefit. This benefit can be used to cover funeral expenses, pay off debts, or provide financial support for your family. Life insurance acts as a safety net, ensuring that your loved ones are taken care of even if you’re not there to do it yourself.

What Are Annuities?

An annuity is a financial product that provides a steady stream of payments over a period of time. You contribute money to the annuity during its accumulation phase, and once you reach the distribution phase, you start receiving regular payments. Annuities can be a valuable tool for retirement planning, as they can help you generate a reliable source of income during your golden years.

How Annuities Complement Life Insurance

While annuities and life insurance serve distinct purposes, they can work synergistically to enhance your financial security. Life insurance provides a blanket of protection for your family, ensuring their financial well-being in the event of your passing. Annuities, on the other hand, provide a structured way to save for retirement, ensuring a steady stream of income that can supplement your Social Security benefits and other retirement savings.

Choosing the Right Annuity for Your Needs

Selecting the appropriate annuity for your specific needs can be a daunting task. There are a plethora of annuity options available, each with its own unique features and benefits. It’s essential to carefully consider your financial goals, risk tolerance, and time horizon before making a decision. Consulting with a qualified financial advisor can provide valuable insights into choosing the annuity that best suits your individual circumstances.

Benefits of Combining Annuities and Life Insurance

Combining annuities and life insurance offers a multitude of advantages:

-

Financial Security: Annuities and life insurance provide a comprehensive safety net, ensuring financial protection for your family both during your life and after your passing.

-

Asset Diversification: Annuities and life insurance are distinct asset classes, offering diversification benefits to your portfolio.

-

Estate Planning: Life insurance can be a valuable estate planning tool, reducing the tax burden on your beneficiaries and ensuring the smooth distribution of your assets.

-

Retirement Income: Annuities can provide a steady stream of income during retirement, allowing you to enjoy a secure financial future.

Conclusion

Annuities and life insurance are indispensable tools for financial planning. By understanding their distinct roles and how they can complement each other, you can craft a comprehensive financial strategy that provides peace of mind and financial security for yourself and your loved ones. Remember, financial planning is an ongoing journey, and it’s crucial to periodically review and adjust your strategy to ensure it aligns with your evolving goals and circumstances.

Annuities and Life Insurance: A Comprehensive Guide to Financial Protection

In today’s uncertain economic landscape, it’s more important than ever to have a solid financial plan in place. Annuities and life insurance are two essential components of a well-rounded financial strategy, providing peace of mind and protection for you and your loved ones. This comprehensive guide will delve into the intricacies of annuities and life insurance, empowering you to make informed decisions about your financial future.

Types of Life Insurance

Life insurance is a contract between you and an insurance company that guarantees a death benefit to your beneficiaries upon your passing. There are two main types of life insurance: term life insurance and whole life insurance.

Term life insurance provides coverage for a specific period of time, such as 10, 20, or 30 years. It’s typically more affordable than whole life insurance and is a good option for those who need temporary coverage for a particular stage of life, such as when raising a family or paying off a mortgage.

Whole life insurance provides lifelong coverage and also has a savings component known as a cash value account. Over time, the cash value account grows tax-deferred, and you can borrow against it or withdraw funds as needed. Whole life insurance is more expensive than term life insurance but offers a wider range of benefits.

Types of Annuities

An annuity is a financial contract that provides a series of regular payments, typically for the rest of your life. There are three main types of annuities: immediate annuities, deferred annuities, and variable annuities.

Immediate annuities provide payments that begin shortly after you make your investment. They’re a good option for those who need a guaranteed income stream in retirement.

Deferred annuities allow you to accumulate money over time, with payments starting at a later date. They’re a good option for those who want to save for a specific goal, such as retirement or a child’s education.

Variable annuities offer the potential for higher returns than fixed annuities, but they also come with more risk. The value of the annuity is linked to the performance of an underlying investment portfolio, which can fluctuate with the market.

Combining Annuities and Life Insurance

Combining annuities and life insurance can provide a comprehensive financial protection strategy. Annuities can provide a guaranteed income stream in retirement, while life insurance ensures that your loved ones will be financially secure in the event of your untimely passing.

For example, a 50-year-old non-smoker can expect to pay around $40 per month for a $250,000 term life insurance policy. The same person could also invest $1,200 per year in a fixed deferred annuity. Over 20 years, the annuity would accumulate to over $30,000, providing an additional source of income in retirement.

Factors to Consider

When choosing annuities and life insurance, it’s important to consider your individual financial needs and goals. Here are a few factors to keep in mind:

Conclusion

Annuities and life insurance are essential components of a well-rounded financial plan. By understanding the different types of annuities and life insurance available, you can make informed decisions that will provide financial protection for yourself and your loved ones. Remember to consult with a qualified financial advisor to determine the best options for your individual needs.